Chipmaker Nvidia Corp. (NASDAQ:NVDA) may have carved out a lead for itself in AI that is nearly impossible to dislodge, according to a former Advanced Micro Devices Inc. (NASDAQ:AMD) engineer, who believes that the latter might still have an upper hand across a few niche areas.

What Happened: On Monday, AlphaSense, an expert network that connects investors with subject-matter experts, shared the call transcript of one such conversation between an analyst and an ex-AMD engineer.

The expert in the call outlined the reasons Nvidia’s dominance in AI seems unassailable, and it has to do with what’s currently being taught to students at the university level.

According to the expert, universities are training students on Nvidia's software, making its tools and libraries the default.

See Also: TSMC CEO Admits Trump Tariffs Have ‘Some Impact’ On Chipmaker But Demand ‘Consistently Outpacing’ Supply Thanks To AI

They credit this to the company’s early and aggressive investment in AI tooling, leaving it with such a deeply entrenched software dominance that newer entrants and even established rivals like AMD might struggle to match.

“Nvidia was investing extremely heav[ily]… 20 years ago, on AI and large language models,” the expert said. “You could almost call it throwing away money at the time.”

This strategy, they note, has since paid off, with Nvidia now having what they call an “unassailable tool flow and library for all things AI.”

Yet, they highlighted certain meaningful strengths of AMD, particularly in the realm of robotics. Unlike Nvidia's top-down strategy focused on high-level processing, AMD has built credibility in low-level motor control and embedded systems, they say.

In fact, companies like Intuitive Surgical Inc. (NASDAQ:ISRG) and ABB Ltd. (OTC:ABBNY) have both publicly endorsed AMD for its contributions to real-time robotics tasks.

While Nvidia dominates in vision AI and large-scale inference, areas crucial to humanoid robotics and LLM applications, AMD's bottom-up capabilities position it well in industrial and healthcare robotics, where power efficiency and real-time control matter more than raw GPU horsepower, according to the expert.

Why It Matters: According to recent reports, AMD is catching up with Nvidia in the GPU race rather quickly, with new products that offer considerably more bang for the buck, or as one reviewer called it, “15% better gaming performance per dollar,” relative to Nvidia’s 5060 Ti.

Tech giants, such as Elon Musk’s xAI, too, have committed to buying many GPUs from Nvidia in the months to come, along with “some from AMD.”

Price Action: AMD shares were up 3.52% on Monday, trading at $114.63, while Nvidia shares traded at $137.38, up 1.37%. Both stocks are flat after hours, up 0.11% and 0.01%, respectively.

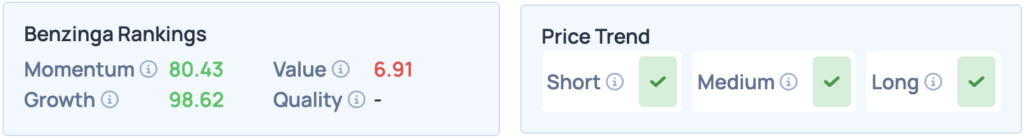

Nvidia ranks well on Momentum and Growth according to Benzinga’s Edge Stock Rankings, while having a favorable price trend in the short, medium, and long term. How does it compare with Nvidia? Click here to find out.

Photo Courtesy: Hepha1st0s On Shutterstock.com

Read More: