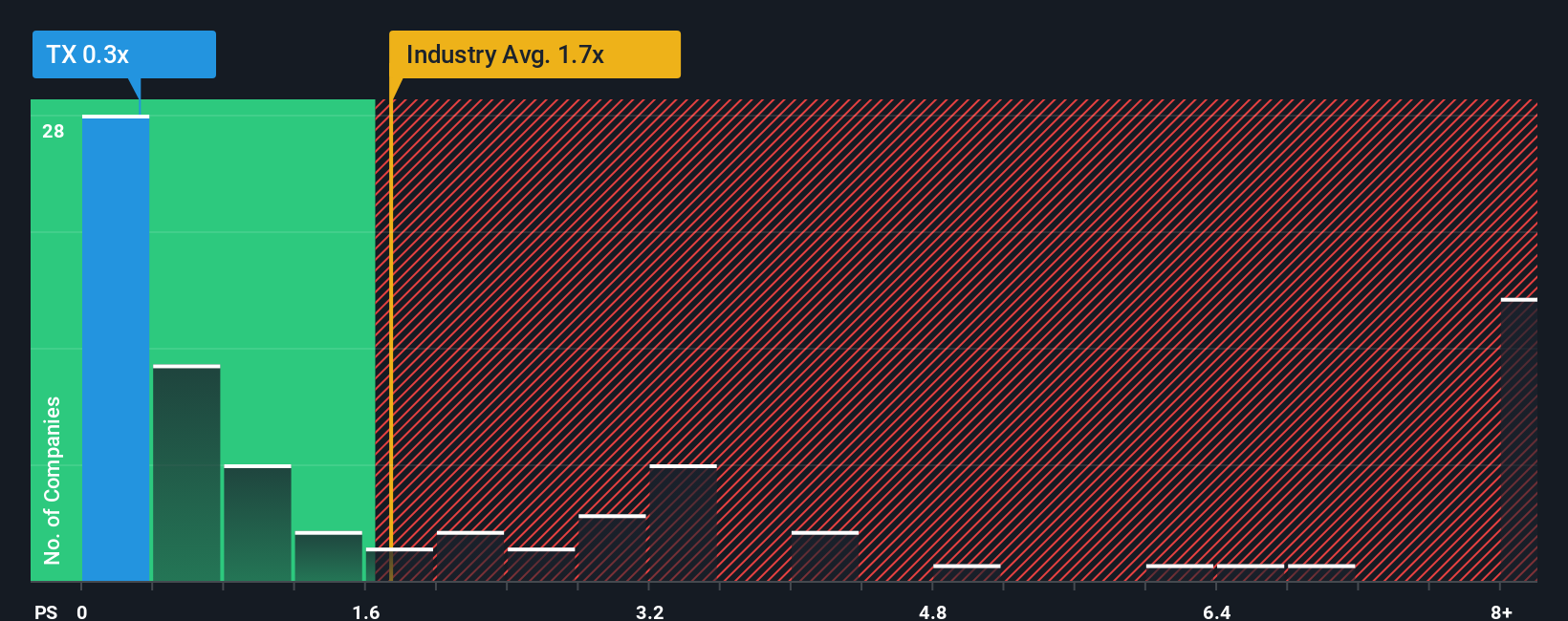

Ternium S.A.'s (NYSE:TX) price-to-sales (or "P/S") ratio of 0.3x might make it look like a buy right now compared to the Metals and Mining industry in the United States, where around half of the companies have P/S ratios above 1.7x and even P/S above 6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Ternium

How Has Ternium Performed Recently?

Ternium could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Ternium will help you uncover what's on the horizon.How Is Ternium's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Ternium's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 2.0% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the twelve analysts covering the company suggest revenue should grow by 3.9% per year over the next three years. With the industry predicted to deliver 4.8% growth per year, the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Ternium's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Ternium's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Ternium currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Ternium that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.