EPAM Systems (NYSE:EPAM) announced amendments to its Articles of Association during its AGM on May 22, 2025, which could potentially impact its governance structure. Over the past month, EPAM’s shares rose by 11%, coinciding with positive developments such as expanded strategic collaboration with Amazon Web Services and ongoing share repurchases. Despite broader market indices remaining relatively flat, the company's substantial Q1 earnings report and future revenue guidance might have supported the upward momentum in its stock price. Leadership changes, including the upcoming transition of its CEO, may also have influenced investor sentiment positively.

The recent amendments to EPAM Systems' Articles of Association could influence its governance structure, potentially affecting long-term investor confidence. Over the past year, EPAM's total shareholder return, including share price and dividends, reported a slight decline of 0.35%. Comparatively, the company fell behind the US IT industry, which saw a strong return of 32.3% over the same period. This underperformance could signal challenges in market positioning despite short-term share price gains.

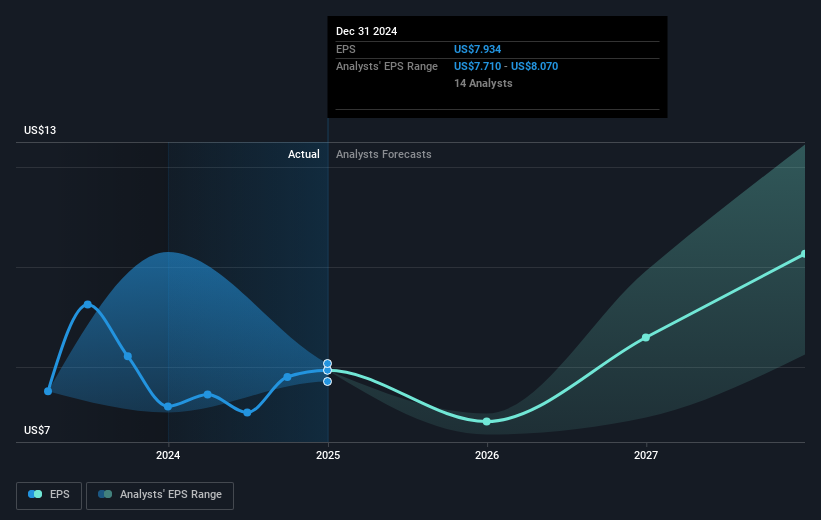

The moves to expand strategic collaboration with Amazon Web Services and ongoing share repurchases are likely to support future revenue and earnings forecasts, particularly as EPAM enhances its AI and GenAI platforms. Yet, the necessity to invest in these growth areas amid potentially challenging pricing environments could pressure margins in the near term. EPAM's share price currently stands at US$157.88, a figure notably below the consensus analyst price target of US$218.27, indicating a possible valuation gap that suggests room for recovery if revenue and earnings expectations materialize as predicted.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com