Verisk Analytics (NasdaqGS:VRSK) implemented significant governance changes on May 20, enhancing shareholder rights by simplifying voting processes and updating officer liability policies. These adjustments, alongside a strong earnings report earlier in the month, may have supported the company's 11% price rise over the past month. While the broader market showed minimal change amid anticipation of Nvidia's earnings, Verisk’s governance reforms and financial performance likely provided positive momentum. Despite the minor broader market fluctuations, Verisk’s focused improvements seem to have resonated well with investors, contributing to the company's notable price appreciation.

Find companies with promising cash flow potential yet trading below their fair value.

The governance changes at Verisk Analytics have the potential to enhance shareholder engagement and confidence, potentially reinforcing long-term investor trust. This may support the company's strategic initiatives, aligning managerial actions with shareholder interests, potentially impacting revenue and earnings positively through better decision-making processes and stronger financial health.

Over a five-year period, Verisk’s total returns, including dividends, reached 90.81%, indicating a robust performance amidst market fluctuations. This positions the firm favorably relative to its recent one-year performance where it exceeded the US Professional Services industry's return of 10.4%. Such long-term growth suggests consistent value creation for shareholders, contrasting with short-term market shifts.

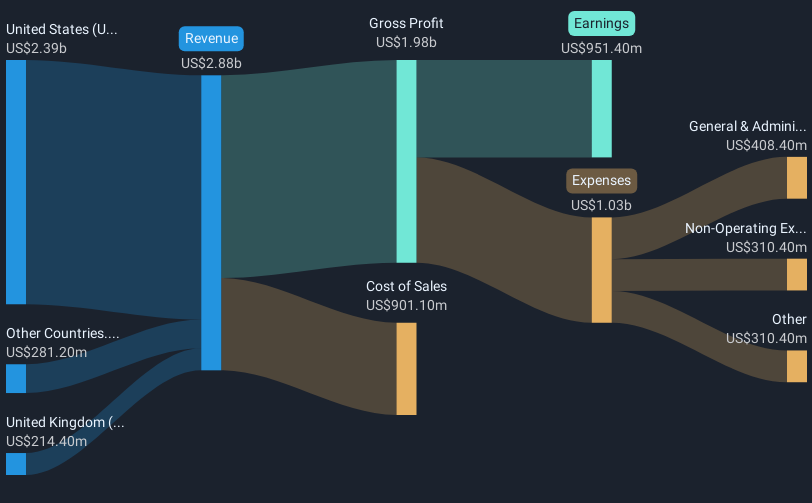

The recent governance improvements, coupled with favorable earnings forecasts, may continue to bolster investor confidence. Analysts predict that revenue will grow by 7.1% annually over the next three years. Such projected growth could positively influence investor perceptions, potentially driving share price adjustments in alignment with the forecasted increases in earnings reaching US$1.2 billion by 2028.

Current market conditions show Verisk's share price discounted by 3.47% to the consensus analyst price target of US$305.20. This relatively small gap suggests that the market largely aligns with analyst estimations, indicating that the recent governance changes and sustained earnings growth could instill further confidence in reaching this target.

Understand Verisk Analytics' track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com