Over the last 7 days, the United States market has experienced a 2.7% drop, yet it remains up by 9.1% over the past year with earnings projected to grow by 14% annually in the coming years. In this context, identifying small-cap stocks that are perceived as undervalued and show signs of insider buying can offer intriguing opportunities for investors seeking potential growth amidst fluctuating market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.0x | 2.8x | 48.29% | ★★★★★☆ |

| Citizens & Northern | 11.0x | 2.7x | 48.74% | ★★★★☆☆ |

| Barrett Business Services | 20.3x | 0.9x | 48.33% | ★★★★☆☆ |

| Shore Bancshares | 9.7x | 2.4x | -68.29% | ★★★☆☆☆ |

| Niagen Bioscience | 55.3x | 7.2x | 27.14% | ★★★☆☆☆ |

| MVB Financial | 12.8x | 1.7x | 39.77% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -57.81% | ★★★☆☆☆ |

| BlueLinx Holdings | 13.8x | 0.2x | -72.96% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.4x | -2766.72% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -369.05% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

CompX International (NYSEAM:CIX)

Simply Wall St Value Rating: ★★★☆☆☆

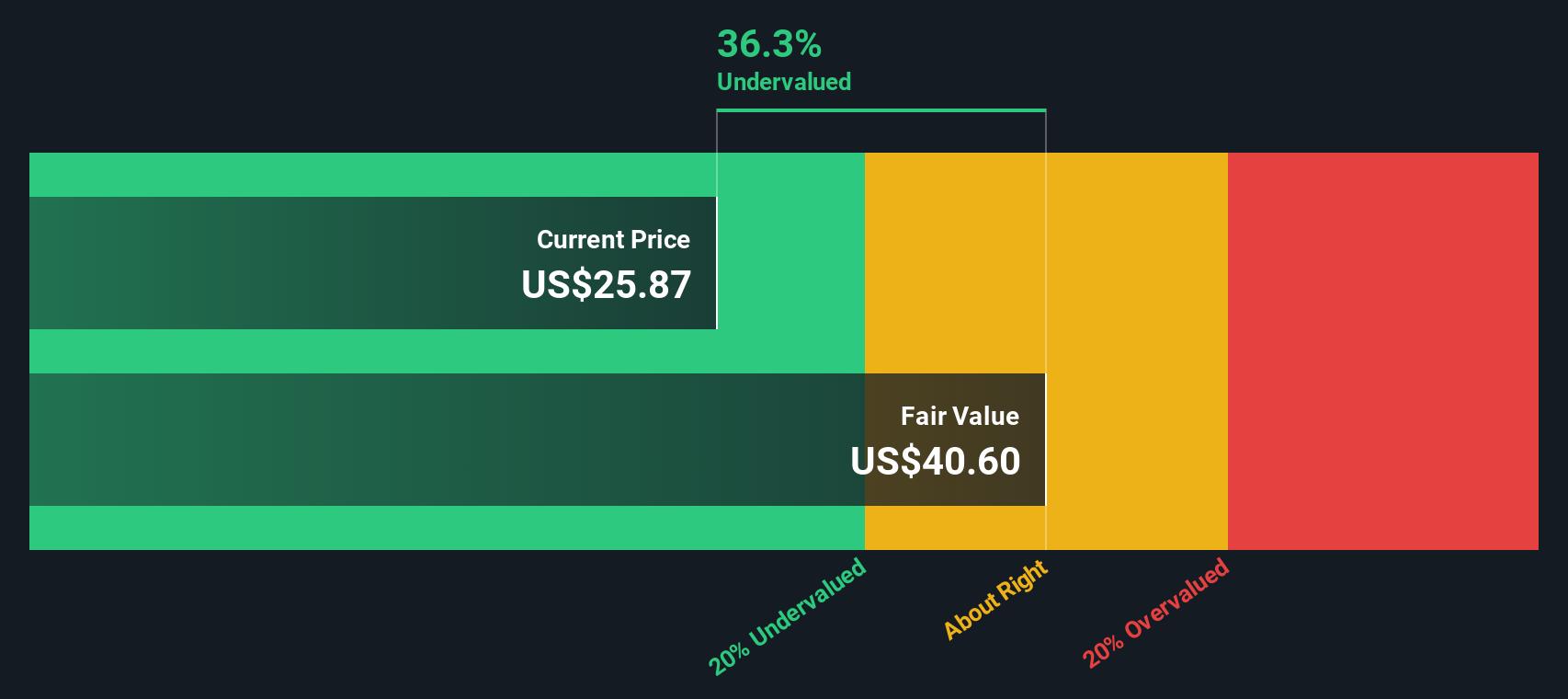

Overview: CompX International is a company specializing in the manufacturing of security products and marine components, with a market capitalization of approximately $0.29 billion.

Operations: The company generates revenue primarily through its Security Products and Marine Components segments, with the majority coming from Security Products. Over recent periods, the net profit margin has varied, reaching 14.01% in December 2023 before declining to 11.37% by December 2024.

PE: 17.3x

CompX International, a small company in the U.S., recently reported an increase in Q1 2025 sales to US$40.27 million from US$37.97 million the previous year, with net income rising to US$5.13 million. Despite relying solely on external borrowing for funding, which carries higher risk, insider confidence is evident through share purchases earlier this year. The company continues its tradition of paying a quarterly dividend of $0.30 per share, reflecting stable cash flow management amidst industry challenges.

Caledonia Mining (NYSEAM:CMCL)

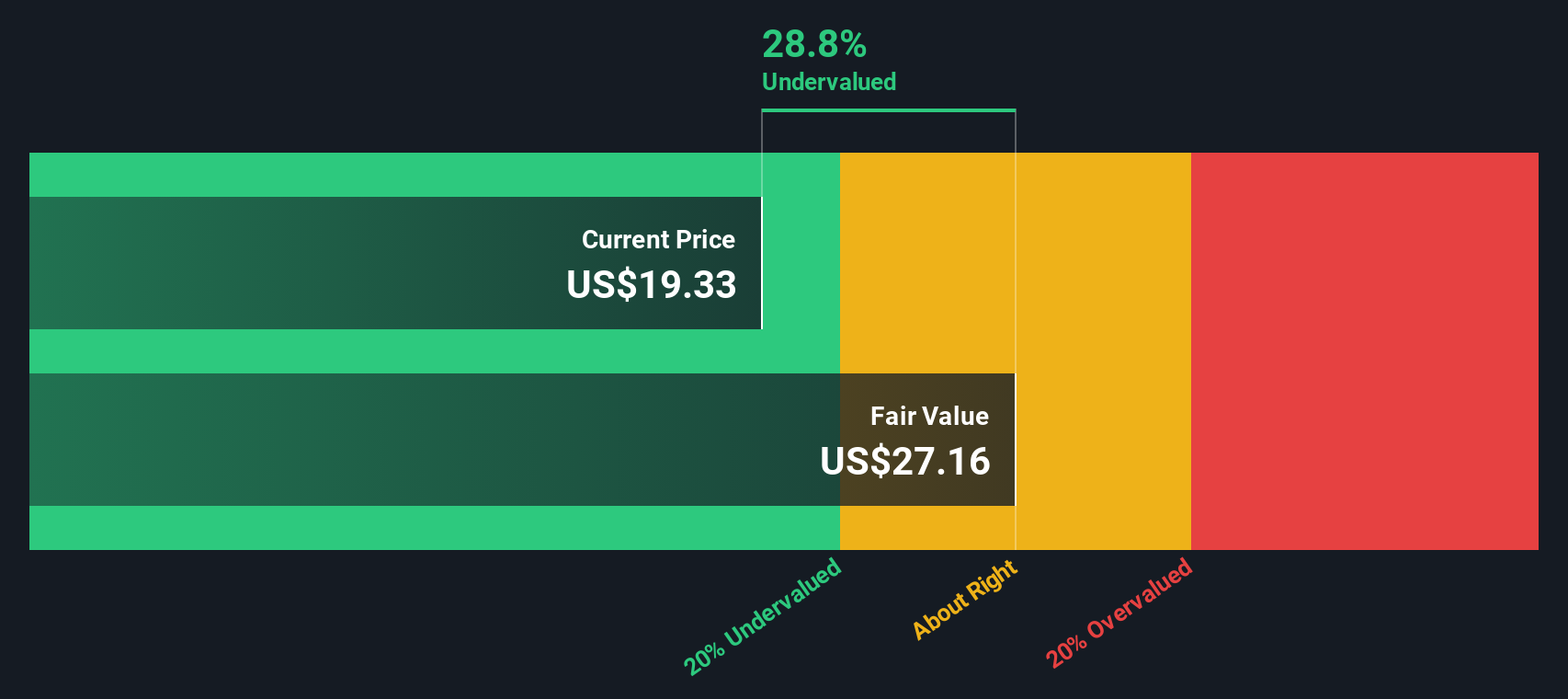

Simply Wall St Value Rating: ★★★★★☆

Overview: Caledonia Mining is a mining company primarily involved in the extraction of gold, with operations focused on the Blanket Mine in Zimbabwe and additional interests in South Africa and the Bilboes Oxide Mine, boasting a market capitalization of approximately $0.12 billion.

Operations: Caledonia Mining generates revenue primarily from its Blanket mine, with additional income from operations in South Africa and the Bilboes Oxide Mine. The company's cost of goods sold (COGS) has shown variability, impacting its gross profit margin which was 55.80% as of March 2025. Operating expenses have been significant, including general and administrative costs, which influence net income outcomes.

PE: 13.5x

Caledonia Mining, a player in the mining industry, showcases potential as an undervalued investment with promising growth prospects. The company reported strong Q1 2025 results with sales reaching US$56.18 million and net income climbing to US$8.92 million from US$1.49 million year-over-year. Insider confidence is reflected through recent purchases, suggesting optimism about future performance. With gold production guidance reaffirmed at 74,000 to 78,000 ounces for 2025 and ongoing feasibility studies at Bilboes project enhancing economic viability, Caledonia's strategic initiatives could drive substantial value creation despite its reliance on external borrowing for funding.

NexPoint Real Estate Finance (NYSE:NREF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NexPoint Real Estate Finance is a real estate investment trust focused on originating, structuring, and managing mortgage loans for commercial real estate properties, with a market cap of approximately $0.35 billion.

Operations: NexPoint Real Estate Finance generates revenue primarily from its REIT - Mortgage segment. The company has experienced fluctuations in its net income margin, which was -0.44% at one point and reached up to 43.69% later on. Operating expenses have varied, impacting overall profitability, with a recent gross profit margin of 98.79%.

PE: 5.4x

NexPoint Real Estate Finance, a small cap player in the U.S., faces challenges with its reliance on external borrowing for funding and a forecasted earnings decline of 15.7% annually over the next three years. Despite these hurdles, insider confidence shines through recent share purchases, signaling potential internal optimism. In Q1 2025, NexPoint reported net income of US$21.8 million and EPS of US$0.7, while forecasting Q2 net income at US$15,175 at midpoint with EPS of US$0.38 per share.

Key Takeaways

- Gain an insight into the universe of 110 Undervalued US Small Caps With Insider Buying by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com