Top 2 Financial Stocks That May Keep You Up At Night In May

Benzinga · 05/22 12:22

Share

Listen to the news

As of May 22, 2025, two stocks in the financial sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

KB Financial Group Inc (NYSE:KB)

- On April 25, KB Financial Group filed its annual report on Form 20-F. The company's stock jumped around 21% over the past month and has a 52-week high of $72.89.

- RSI Value: 82.9

- KB Price Action: Shares of KB Financial gained 2.1% to close at $70.84 on Wednesday.

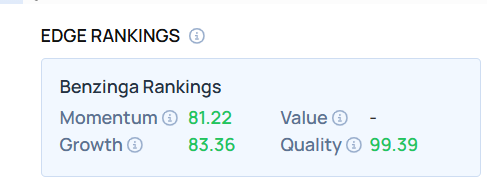

- Edge Stock Ratings: 81.22 Momentum score.

Robinhood Markets Inc (NASDAQ:HOOD)

- Robinhood Markets proposed a federal framework to the U.S. Securities and Exchange Commission for tokenized real-world assets, according to a report dated Tuesday. Robinhood's letter, addressed to SEC Chair Paul Atkins and Commissioner Hester Peirce, outlined a plan for a unified national framework for bringing real-world assets on-chain, according to Forbes. The company's stock gained around 52% over the past month and has a 52-week high of $66.89.

- RSI Value: 71.5

- HOOD Price Action: Shares of Robinhood fell 1.6% to close at $63.86 on Wednesday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved