The United States market has shown positive momentum, climbing 1.6% in the last week and achieving a 12% increase over the past year, with earnings projected to grow by 14% annually. In such a dynamic environment, identifying stocks that are not only poised for growth but also remain underappreciated can offer unique opportunities for investors seeking to uncover hidden potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Central Bancompany | 32.38% | 5.41% | 6.60% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -25.87% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Pure Cycle (NasdaqCM:PCYO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pure Cycle Corporation operates in the United States, offering wholesale water and wastewater services, with a market capitalization of $261.23 million.

Operations: The company's revenue streams include land development ($17.28 million), single-family rental ($0.49 million), and water and wastewater resource development ($12.15 million).

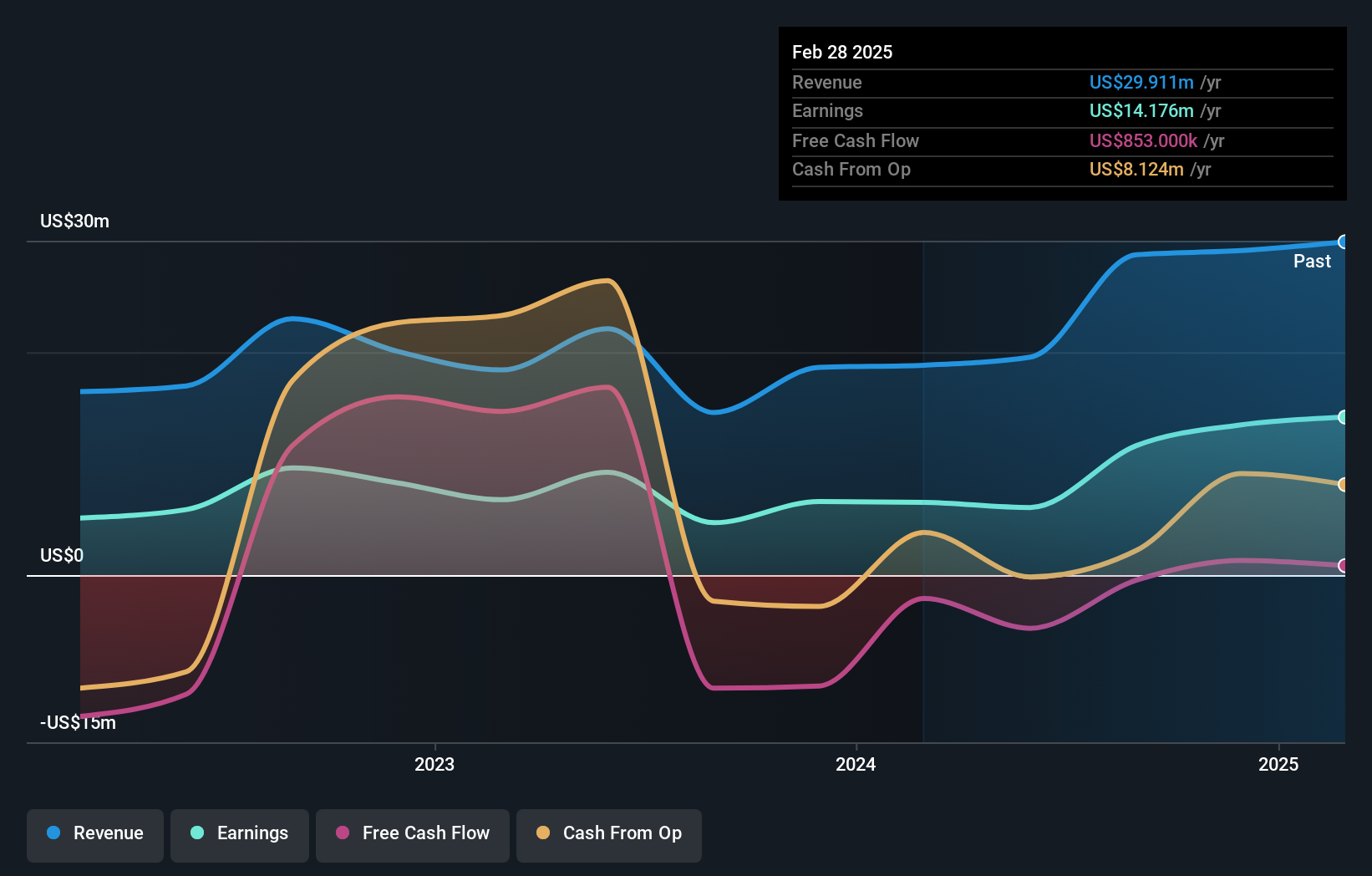

Pure Cycle, a nimble player in the water utilities sector, has showcased impressive earnings growth of 116.9% over the past year, outpacing the industry's 8.1%. Despite a rise in its debt-to-equity ratio from 0% to 5.1% over five years, it holds more cash than total debt, indicating financial stability. The company recently reported second-quarter sales of US$4 million and net income of US$0.809 million, both up from last year’s figures. With a price-to-earnings ratio of 18.6x below industry average and recent share buybacks totaling US$0.91 million for nearly 88k shares, Pure Cycle seems well-positioned for potential value appreciation.

- Click here and access our complete health analysis report to understand the dynamics of Pure Cycle.

Review our historical performance report to gain insights into Pure Cycle's's past performance.

PCB Bancorp (NasdaqGS:PCB)

Simply Wall St Value Rating: ★★★★★★

Overview: PCB Bancorp is the bank holding company for PCB Bank, offering a range of banking products and services to small and middle-market businesses and individuals, with a market cap of $288.79 million.

Operations: PCB Bancorp generates revenue primarily from its banking operations, with the banking industry contributing $98.72 million.

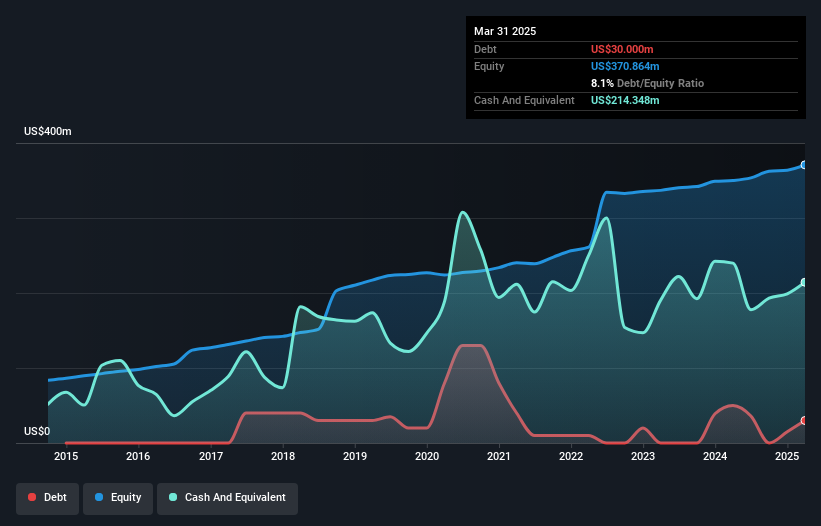

PCB Bancorp, with total assets of US$3.2 billion and equity of US$370.9 million, stands out for its robust financial health. The bank's allowance for bad loans is a notable 511%, ensuring stability with non-performing loans at just 0.2%. Its funding structure is primarily low risk, relying heavily on customer deposits which make up 96% of liabilities. Earnings have shown impressive growth, increasing by 11.7% last year and surpassing the industry average of 5%. Despite recent delays in SEC filings, PCB remains an intriguing prospect given its strong fundamentals and undervaluation at 46.6% below estimated fair value.

- Get an in-depth perspective on PCB Bancorp's performance by reading our health report here.

Understand PCB Bancorp's track record by examining our Past report.

Five Point Holdings (NYSE:FPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Five Point Holdings, LLC is involved in the design, ownership, and development of mixed-use planned communities across Orange County, Los Angeles County, and San Francisco County, with a market capitalization of approximately $826.10 million.

Operations: Five Point Holdings generates revenue primarily from its Great Park and Valencia segments, with Great Park contributing $905.39 million and Valencia adding $140.24 million. The company recorded a segment adjustment of $0.34 million, while the removal of Great Park Venture accounted for a deduction of $805.50 million in its financials.

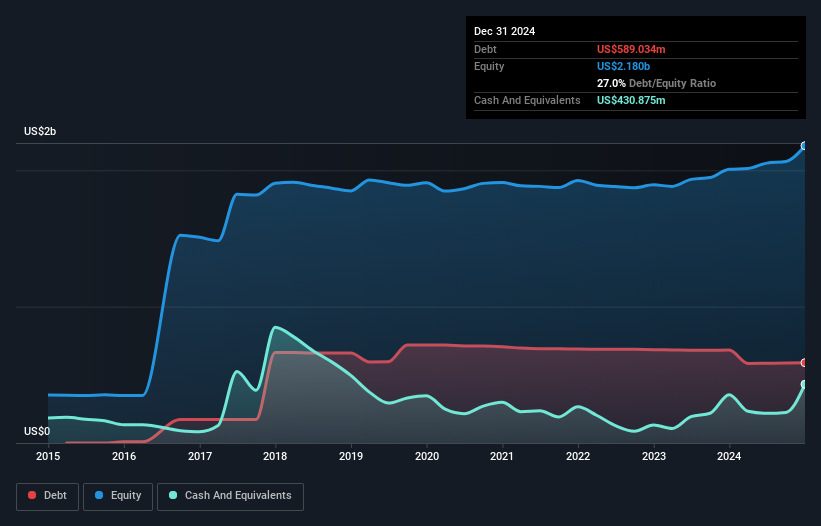

Five Point Holdings, a real estate player, has been making waves with its impressive financial performance. Over the past year, earnings surged by 43.8%, outpacing the industry average of 26.5%. The company's net debt to equity ratio stands at a satisfactory 2.7%, reflecting prudent financial management as it reduced from 38.9% over five years. Recent results show revenue climbing to US$13.16 million from US$9.94 million last year, while net income skyrocketed to US$23.28 million from just US$2.33 million previously, indicating strong profitability and high-quality earnings that cover interest payments comfortably.

- Take a closer look at Five Point Holdings' potential here in our health report.

Assess Five Point Holdings' past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Dive into all 282 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com