As global markets navigate trade discussions and economic uncertainties, investors are increasingly turning their attention to the potential of smaller, lesser-known stocks. Penny stocks, a term that may seem outdated but remains relevant, typically refer to shares of smaller or newer companies that offer growth opportunities at lower price points. Despite their reputation for risk, when these stocks are backed by strong financials and sound fundamentals, they can present unique opportunities for growth.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| T.A.C. Consumer (SET:TACC) | THB4.58 | THB2.75B | ✅ 4 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.40 | SGD162.12M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.186 | SGD37.05M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.20 | SGD8.66B | ✅ 5 ⚠️ 0 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.13 | SGD858.72M | ✅ 3 ⚠️ 2 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.94 | HK$3.35B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.38 | HK$50.14B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.18 | HK$744.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.35 | HK$2.25B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.16 | HK$1.8B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,178 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Sunshine Insurance Group (SEHK:6963)

Simply Wall St Financial Health Rating: ★★★★☆☆

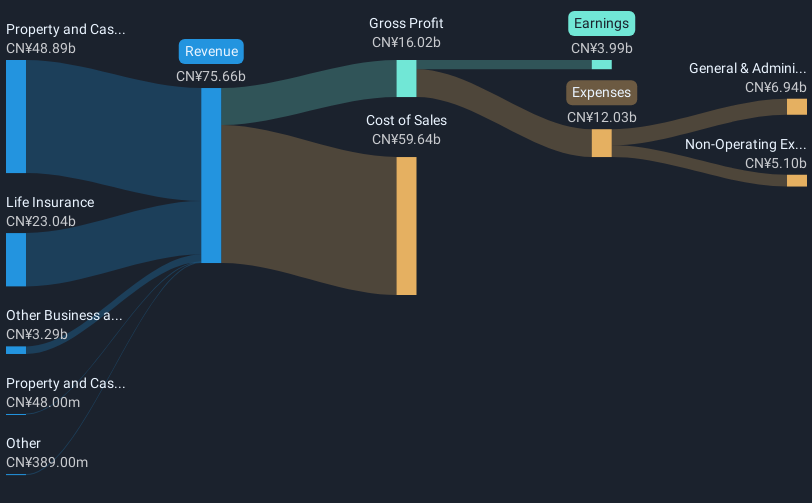

Overview: Sunshine Insurance Group Company Limited offers a range of insurance products and services in the People’s Republic of China, with a market capitalization of approximately HK$40.26 billion.

Operations: The company's revenue is primarily derived from its Property and Casualty Insurance segment, with Sunshine P&C generating CN¥50.22 billion, supplemented by Life Insurance contributing CN¥25.03 billion and Sunshine Surety adding CN¥52 million.

Market Cap: HK$40.26B

Sunshine Insurance Group, with a market cap of HK$40.26 billion, shows promise in the Asian penny stock landscape despite some challenges. Recent earnings growth of 45.8% and a net income rise to CN¥5.45 billion reflect strong performance, although long-term liabilities remain uncovered by short-term assets. The company declared a dividend increase to RMB 2,185 million for 2024, indicating shareholder value focus. However, the board's lack of experience could be concerning amidst executive resignations and leadership transitions. Despite low return on equity at 8.7%, debt is well-covered by cash flow and interest payments are secure with EBIT coverage at 7.2 times.

- Click here to discover the nuances of Sunshine Insurance Group with our detailed analytical financial health report.

- Understand Sunshine Insurance Group's earnings outlook by examining our growth report.

AEM Holdings (SGX:AWX)

Simply Wall St Financial Health Rating: ★★★★☆☆

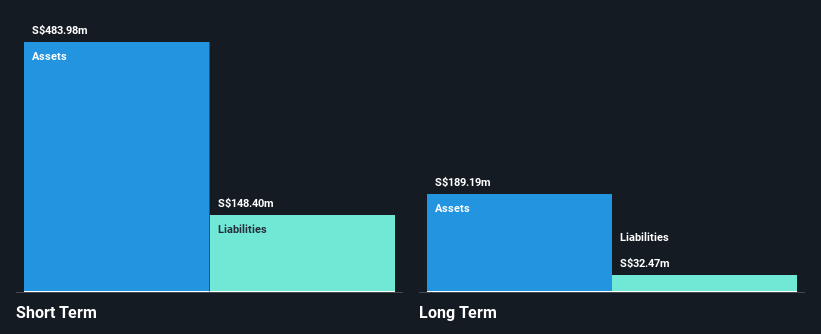

Overview: AEM Holdings Ltd. and its subsidiaries offer semiconductor and electronics test solutions globally, with a market capitalization of SGD404 million.

Operations: The company's revenue is derived from Test Cell Solutions (SGD230.97 million), Contract Manufacturing (SGD153.93 million), and Instrumentation (SGD8.09 million).

Market Cap: SGD404M

AEM Holdings Ltd., with a market cap of SGD404 million, is gaining attention in the penny stock segment due to its recent profitability and stable financial position. The company reported sales of SGD380.41 million for 2024, marking a decrease from the previous year but achieving net income of SGD11.44 million compared to a loss previously. With short-term assets exceeding liabilities and an experienced board, AEM shows financial stability despite low return on equity at 2.4%. Recent leadership changes include appointing Yeo Yee Chia as an Independent Director, potentially enhancing strategic insights amidst ongoing industry challenges.

- Unlock comprehensive insights into our analysis of AEM Holdings stock in this financial health report.

- Explore AEM Holdings' analyst forecasts in our growth report.

Zhongzhu Healthcare HoldingLtd (SHSE:600568)

Simply Wall St Financial Health Rating: ★★★★★★

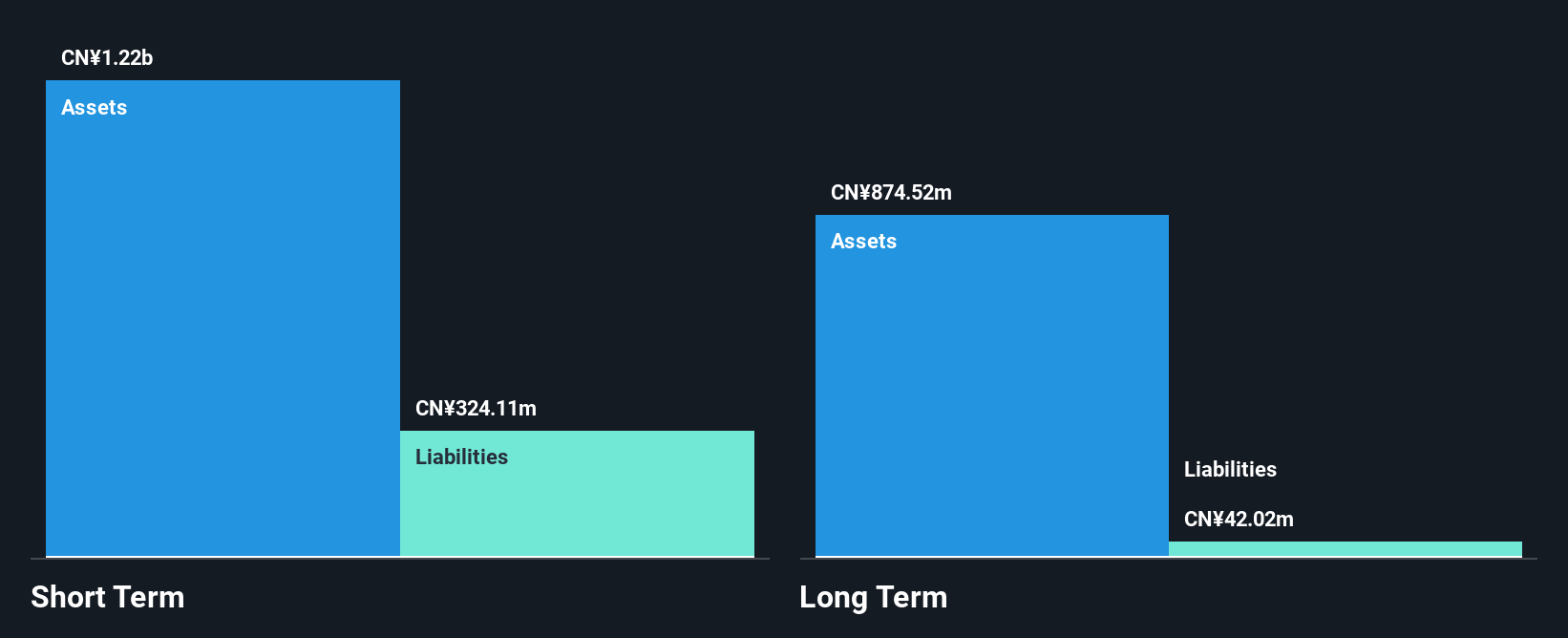

Overview: Zhongzhu Healthcare Holding Co., Ltd operates in the research, development, production, and sales of pharmaceutical drugs in China with a market cap of CN¥2.86 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥2.86B

Zhongzhu Healthcare Holding Co., Ltd, with a market cap of CN¥2.86 billion, operates in the pharmaceutical sector and recently reported Q1 2025 revenue of CN¥141.46 million. Despite its unprofitable status and rising losses over five years, the company benefits from being debt-free and having a strong cash runway exceeding three years due to positive free cash flow growth. Its short-term assets significantly cover both short- and long-term liabilities, ensuring financial resilience amidst volatility. The seasoned management team supports potential strategic stability while trading below estimated fair value suggests possible investment appeal in the penny stock segment.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhongzhu Healthcare HoldingLtd.

- Evaluate Zhongzhu Healthcare HoldingLtd's historical performance by accessing our past performance report.

Taking Advantage

- Navigate through the entire inventory of 1,178 Asian Penny Stocks here.

- Ready To Venture Into Other Investment Styles? Outshine the giants: these 29 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com