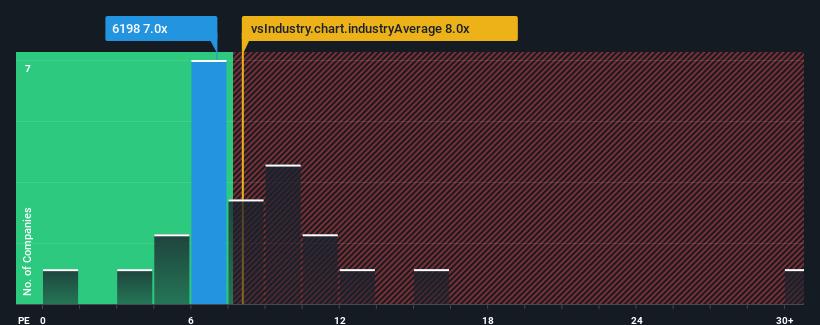

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 12x, you may consider Qingdao Port International Co., Ltd. (HKG:6198) as an attractive investment with its 7x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Qingdao Port International certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Qingdao Port International

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Qingdao Port International would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a decent 7.8% gain to the company's bottom line. Pleasingly, EPS has also lifted 32% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 1.4% per year during the coming three years according to the sole analyst following the company. That's not great when the rest of the market is expected to grow by 15% per annum.

With this information, we are not surprised that Qingdao Port International is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Qingdao Port International's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Qingdao Port International maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - Qingdao Port International has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

You might be able to find a better investment than Qingdao Port International. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.