Walmart (NYSE:WMT) experienced a price move of 4% last month as it launched several new products in collaboration with various partners. This includes Legendairy Milk's women's health line, which was introduced at over 1,600 Walmart stores, and the expansion of LK meat sticks to 2,800 locations. While these product launches could enhance Walmart's attractiveness to consumers, the 4% price movement aligns closely with broader market trends, including a significant rally fueled by eased U.S.-China tariffs. Therefore, these expansion efforts likely added modest weight to Walmart's upward move during a favorable market period.

You should learn about the 1 weakness we've spotted with Walmart.

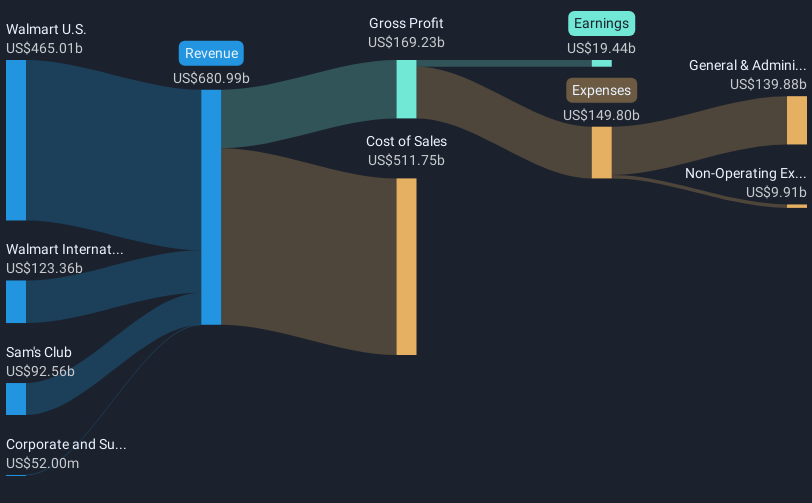

The recent product launches, including Legendairy Milk's women's health line and LK meat sticks, could bolster Walmart's narrative by enhancing its product diversity and consumer appeal. These initiatives may contribute positively to revenue and earnings forecasts, although their direct impact might be modest given the scale of Walmart's extensive operations. Longer-term, such partnerships and expansions into higher-margin ventures like e-commerce and marketplace models support the company's strategic shift towards enhancing profitability and net margins.

Over the past five years, Walmart's total return of 144.09% highlights its capacity for consistent growth and value creation for shareholders. In comparison, over the past year, Walmart's performance exceeded the US market, which returned 8%, and surpassed the Consumer Retailing industry's 32.7% return. This suggests robust resilience and competitiveness in the retail sector.

Considering the analysts' consensus price target of $107.01, Walmart's current share price of $98.55 suggests a 7.9% potential upside. While the latest news may influence sentiment positively, the modest share price movement indicates that the market might already have priced in such developments. Continued enhancements in operational efficiency through supply chain investments and potential gains from PhonePe's IPO in India are expected to further solidify Walmart's long-term growth trajectory.

Gain insights into Walmart's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com