Church & Dwight (NYSE:CHD) is actively pursuing growth through mergers and acquisitions, highlighted by its recent merger discussions with Touchland Inc. Despite these developments, Church & Dwight's stock remained relatively flat over the past week, slipping just 1.3%. Meanwhile, broader markets surged, with the Dow gaining nearly 1,000 points following a U.S.-China agreement to reduce tariffs. This divergence suggests that recent corporate activity did not significantly counteract or add weight to the broader market's upbeat trend. The focus on strategic expansion indicates the company's commitment to enhancing its portfolio and market presence in diverse conditions.

You should learn about the 1 warning sign we've spotted with Church & Dwight.

The recent merger discussions between Church & Dwight and Touchland Inc. likely aim to bolster long-term strategic growth and enhance the company's product portfolio. Over the past five years, Church & Dwight has delivered a total shareholder return of 32.32%, including both share price appreciation and dividends. This contrasts with the company's performance over the past year, where it has underperformed the broader US Household Products industry, which saw a 6.1% decline in returns. This discrepancy highlights challenges in translating short-term strategic moves like mergers into immediate investor sentiments.

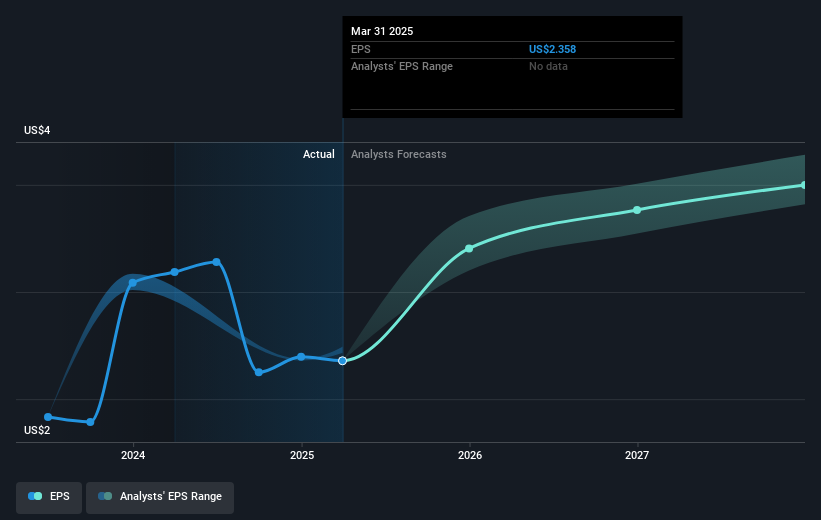

The company's share price, currently trading at US$92.07, reflects an 7.6% discount to the analyst consensus price target of US$99.60. Analysts have projected revenue growth at a slower pace of 2.7% annually, with profit margins anticipated to improve from 9.5% to 15.0% over the next three years. These forecasts hinge on the optimization of core brands and new product launches, which could be positively impacted by the merger with Touchland. However, the recent corporate developments may not considerably alter near-term earnings expectations amid existing tariff risks and other macroeconomic challenges.

Understand Church & Dwight's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com