In the preceding three months, 24 analysts have released ratings for Target (NYSE:TGT), presenting a wide array of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 3 | 15 | 1 | 0 |

| Last 30D | 0 | 0 | 0 | 1 | 0 |

| 1M Ago | 0 | 0 | 3 | 0 | 0 |

| 2M Ago | 0 | 0 | 4 | 0 | 0 |

| 3M Ago | 5 | 3 | 8 | 0 | 0 |

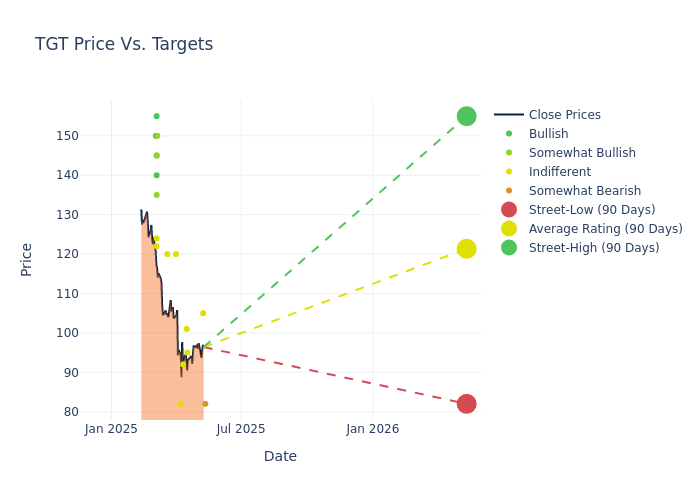

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $124.79, a high estimate of $155.00, and a low estimate of $82.00. Observing a downward trend, the current average is 11.88% lower than the prior average price target of $141.61.

Deciphering Analyst Ratings: An In-Depth Analysis

An in-depth analysis of recent analyst actions unveils how financial experts perceive Target. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Zhihan Ma | Bernstein | Lowers | Underperform | $82.00 | $97.00 |

| Christopher Horvers | JP Morgan | Lowers | Neutral | $105.00 | $140.00 |

| Paul Lejuez | Citigroup | Lowers | Neutral | $95.00 | $120.00 |

| Kate McShane | Goldman Sachs | Lowers | Neutral | $101.00 | $142.00 |

| David Belinger | Mizuho | Announces | Neutral | $92.00 | - |

| Scot Ciccarelli | Truist Securities | Lowers | Hold | $82.00 | $124.00 |

| Greg Melich | Evercore ISI Group | Lowers | In-Line | $120.00 | $130.00 |

| Mark Astrachan | Stifel | Lowers | Hold | $120.00 | $130.00 |

| Rupesh Parikh | Oppenheimer | Lowers | Outperform | $150.00 | $165.00 |

| Edward Kelly | Wells Fargo | Lowers | Overweight | $135.00 | $150.00 |

| Michael Lasser | UBS | Lowers | Buy | $155.00 | $170.00 |

| Robert Ohmes | B of A Securities | Lowers | Buy | $145.00 | $160.00 |

| Scot Ciccarelli | Truist Securities | Lowers | Hold | $124.00 | $134.00 |

| Kate McShane | Goldman Sachs | Lowers | Buy | $142.00 | $166.00 |

| Bill Kirk | Roth MKM | Lowers | Neutral | $122.00 | $131.00 |

| Michael Baker | DA Davidson | Lowers | Buy | $140.00 | $153.00 |

| Paul Lejuez | Citigroup | Lowers | Neutral | $120.00 | $133.00 |

| Peter Keith | Piper Sandler | Lowers | Neutral | $124.00 | $132.00 |

| Mark Astrachan | Stifel | Lowers | Hold | $130.00 | $145.00 |

| Greg Melich | Evercore ISI Group | Lowers | In-Line | $130.00 | $135.00 |

| Christopher Horvers | JP Morgan | Lowers | Neutral | $140.00 | $146.00 |

| Joseph Feldman | Telsey Advisory Group | Lowers | Outperform | $145.00 | $150.00 |

| Corey Tarlowe | Jefferies | Lowers | Buy | $150.00 | $165.00 |

| Christopher Horvers | JP Morgan | Raises | Neutral | $146.00 | $139.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Target. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Target compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

To gain a panoramic view of Target's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Target analyst ratings.

Delving into Target's Background

Target serves as the nation's seventh-largest retailer, with its strategy predicated on delivering a gratifying in-store shopping experience and a wide product assortment of trendy apparel, home goods, and household essentials at competitive prices. Target's upscale and stylish image began to carry national merit in the 1990s—a decade in which the brand saw its top line grow threefold to almost $30 billion—and has since cemented itself as a leading US retailer.Today, Target operates over 1,900 stores in the United States, generates over $100 billion in sales, and fulfills over 2 billion customer orders annually. The firm's vast footprint is typically concentrated in urban and suburban markets as the firm seeks to attract a more affluent consumer base.

Target: Financial Performance Dissected

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Negative Revenue Trend: Examining Target's financials over 3M reveals challenges. As of 31 January, 2025, the company experienced a decline of approximately -3.15% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Consumer Staples sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Target's net margin is impressive, surpassing industry averages. With a net margin of 3.57%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Target's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 7.57%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.9%, the company showcases effective utilization of assets.

Debt Management: Target's debt-to-equity ratio surpasses industry norms, standing at 1.36. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.