Top 3 Industrials Stocks That May Explode This Month

Benzinga · 05/12 12:31

Share

Listen to the news

The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Energy Recovery Inc (NASDAQ:ERII)

- On May 7, Energy Recovery reported worse-than-expected first-quarter financial results. The company's stock fell around 28% over the past five days and has a 52-week low of $10.86.

- RSI Value: 20.2

- ERII Price Action: Shares of Energy Recovery fell 7.2% to close at $11.37 on Friday.

- Edge Stock Ratings: 91.92 Momentum score with Value at 93.51.

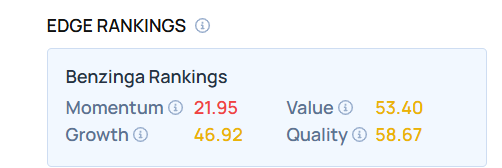

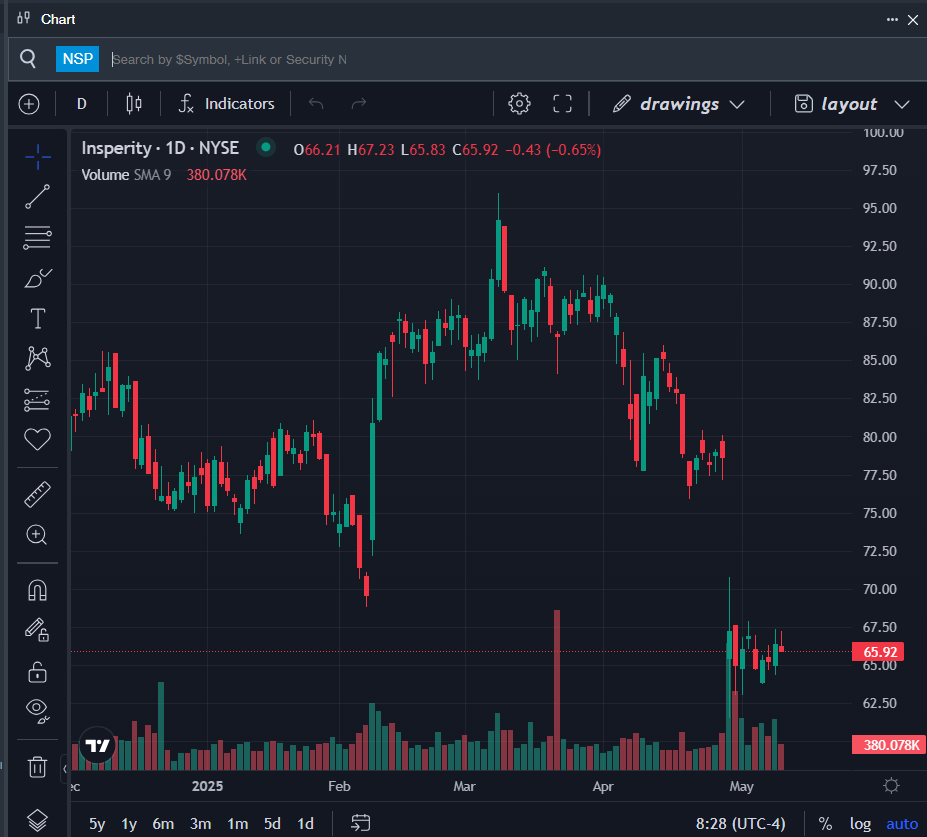

Insperity Inc (NYSE:NSP)

- On April 29, Insperity reported worse-than-expected first-quarter financial results, cut its FY25 adjusted EPS guidance, and issued second-quarter adjusted EPS guidance below estimates. “Our first quarter financial results, reflecting macro-economic turbulence and healthcare cost volatility, are in stark contrast with the solid execution of our game plan for building the foundation for future growth acceleration,” said Paul J. Sarvadi, Insperity chairman and chief executive officer. The company's stock fell around 23% over the past month and has a 52-week low of $61.54.

- RSI Value: 29.8

- NSP Price Action: Shares of Insperity fell 0.7% to close at $65.92 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in NSP stock.

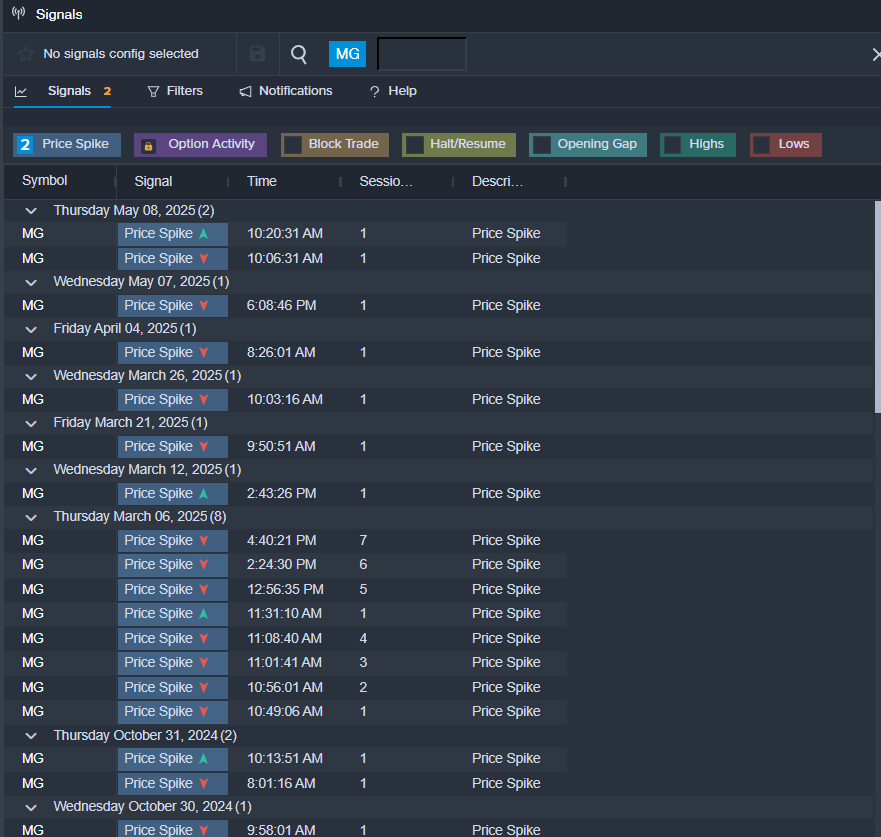

Mistras Group Inc (NYSE:MG)

- On May 7, Mistras Group reported worse-than-expected first-quarter financial results. Natalia Shuman, President and Chief Executive Officer said, “Despite the larger than anticipated year-over-year decline in revenue driven by overall market uncertainty, we were nevertheless able to rapidly calibrate costs and expenses down during the first quarter to our revenue level, in order to preserve our operational metrics. With a continued focus on cost and expense management, including a reduction in our administrative support functional costs, and coupled with anticipated revenue growth across all primary industries, we are confident these drivers will provide an improvement in key profitability measures over the remainder of the year.” The company's stock fell around 16% over the past five days and has a 52-week low of $7.06.

- RSI Value: 28.9

- MG Price Action: Shares of Mistras gained 0.4% to close at $7.82 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in MG shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved