Future Fund LLC's Gary Black believes Tesla Inc. (NASDAQ:TSLA) as well as Uber Technologies Inc. (NYSE:UBER) will benefit from increased EV adoption as well as growth in Autonomous Driving.

What Happened: In a post on the social media platform X, the investor shared his thoughts on why he invested in both companies on Sunday. "We own both $UBER and $TSLA for different reasons,"

Black said that as autonomous driving gathers steam, more companies would adopt the technology and be granted licenses to operate unsupervised robotaxis in the future. "$UBER with 170M MAUs will by 2026 year-end offer a driverless option that reduces the cost per mile from $2/mile to $1/mile," he said in the post.

"We see $UBER Non-GAAP EPS increasing from $3/share in 2025 to $8/share by 2030. Our UBER PT is $120." Black said.

He then talked about Tesla and how Elon Musk's EV giant could stand to gain from increased EV adoption throughout the globe. "We own $TSLA because as global EV adoption increases from its current 20% to 50% by 2030, TSLA deliveries should increase from 1.7M in 2025 to 5.0M by 2030," he shared.

Black also shared how autonomous driving could help boost sales before setting a $310 price target on Tesla stock. "We expect unsupervised autonomy to sell more Teslas and increase the FSD take rate from its current 15% to 33%." the investor said.

Why It Matters: The investor has been an advocate for autonomous vehicles. He had recently doubled down on Uber's growth as autonomous vehicles are steadily gaining pace in the U.S.

Black has also previously shared that Musk's company is "best positioned" to

Capitalize on EV growth in the country. "As EV adoption and demand for autonomy increases, $TSLA remains the best positioned to capitalize on these two megatrends," he said.

Elsewhere, the investor also hailed Uber rival Lyft Inc. (NASDAQ:LYFT) as the ride-hailing service surprised analysts by beating expectations. The company revealed that it attained a $.01 EPS vs a projected -$.02 loss, at the Q1 earnings call last Thursday.

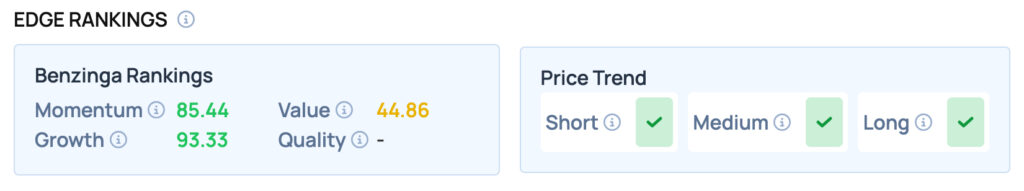

UBER scores well on Momentum and Growth metrics and has a satisfactory score on the value metric. For more such insights, sign up for Benzinga Edge today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: DenPhotos / Shutterstock.com