Fund manager and long-term Tesla Inc. (NASDAQ:TSLA) bull, Gary Black, is weighing in on the long-running debates surrounding the EV giant, the industry’s future, and trends such as autonomy and driverless ridesharing.

What Happened: On Sunday, in a long post on X, Black outlined how his past views on the electric vehicle maker have been validated in recent years, despite the pushback from Tesla’s investor community at the time, whom he dubs as the “TSLA faithful.”

“For years I argued TSLA would never hit 20 million deliveries by 2030,” Black says, referring to CEO Elon Musk's long-term volume target. “I was told Elon said they would, to which I asked, why do you listen to management?”

He noted that Wall Street's current consensus figures for 2030 are now closer to 3.9 million units, and added that many Tesla bulls themselves have since pivoted to downplaying EV delivery volumes as a core valuation metric.

See Also: China’s EV Market Surges Past US and Europe—’China’s Elon Musk’ Shares Two Stats That Explain Why

In his post, Black also criticized the company’s reluctance to embrace traditional advertising and public relations, arguing that as the market leader, it has to communicate the benefits of EVs to ICE (Internal Combustion Engine) vehicle owners to pave the way for broader adoption.

On pricing, Black points out that Tesla’s margin-eroding price cuts in 2023 and 2024 failed to generate any meaningful volume growth, just as he had predicted. He also warns that further price moves with newer models could face similar outcomes.

Turning to autonomy, Black challenged the notion that Tesla is far ahead. “Here we are today with Waymo, AMZN, and Baidu all operating autonomous robotaxi networks,” he says, while Tesla has yet to receive a single deployment license.

“Don't malign me for trying to inject some realism into the TSLA story,” Black says, as he turns his attention towards the growing claims from among the “faithful,” who now believe that Uber Technologies Inc. (NYSE:UBER) and LYFT Inc. (NASDAQ:LYFT) are set to go bankrupt with Tesla’s advances in autonomous driving.

In a follow-up Tweet, Black claimed that these ridesharing companies are set to benefit the most as autonomous mobility takes flight, as going driverless “reduces the cost per mile from $2/mile to $1/mile.” Black, whose firm holds a stake in both Tesla and Uber, maintains the latter’s price target at $120, representing an upside of 45%.

Why It Matters: Despite being a long-time investor in Tesla, Black has been a vocal critic of the company in recent years, having regularly highlighted the brand’s alarming sales data this year, following Musk’s growing political involvement.

He has also repeatedly criticized the company's lack of marketing, calling it its “Achilles' heel,” a weakness he says not only affects sales but also leaves the company at a disadvantage with regulators.

Black, however, remains bullish on the company in the long run, having stated recently that “Long term we like the $TSLA story,” and that “As EV adoption and demand for autonomy increases, $TSLA remains the best positioned to capitalize on these two megatrends.”

| Stocks / ETFs | Year-To-Date Returns |

| Tesla Inc. (NASDAQ:TSLA) | -21.36% |

| Uber Technologies Inc. (NYSE:UBER) | +31.09% |

| LYFT Inc. (NASDAQ:LYFT) | +21.98% |

| Fidelity Electric Vehicles and Future Transpo ETF (BATS:FDRV) | +2.73% |

| iShares Self-Driving EV and Tech ETF (NYSE:IDRV) | +4.51% |

Price Action: Tesla shares were up 4.72% on Friday, and are up 0.35% after hours.

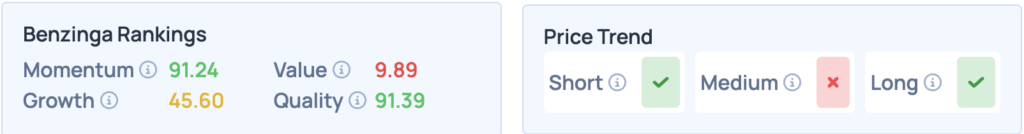

According to Benzinga’s Edge Stock Rankings, Tesla shares score well on momentum and quality, but fall short on growth and value. How does it compare with Uber, Lyft or Rivian, for that matter? Sign up for Benzinga Edge to find out.

Photo Courtesy: G.Tbov On Shutterstock.com

Read More: