We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given this risk, we thought we'd take a look at whether Aligos Therapeutics (NASDAQ:ALGS) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

How Long Is Aligos Therapeutics' Cash Runway?

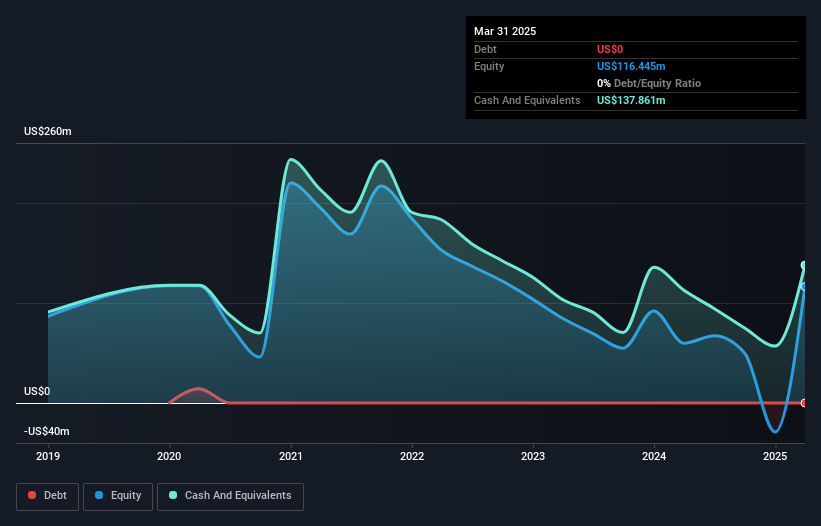

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Aligos Therapeutics last reported its March 2025 balance sheet in May 2025, it had zero debt and cash worth US$138m. Looking at the last year, the company burnt through US$79m. So it had a cash runway of approximately 21 months from March 2025. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. You can see how its cash balance has changed over time in the image below.

Check out our latest analysis for Aligos Therapeutics

How Well Is Aligos Therapeutics Growing?

Over the last year, Aligos Therapeutics maintained its cash burn at a fairly steady level. Meanwhile, its operating revenue raised the white flag and retreated 76% in just one year. In light of the above-mentioned, we're pretty wary of the trajectory the company seems to be on. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Aligos Therapeutics Raise Cash?

Since Aligos Therapeutics revenue has been falling, the market will likely be considering how it can raise more cash if need be. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Aligos Therapeutics has a market capitalisation of US$27m and burnt through US$79m last year, which is 288% of the company's market value. Given just how high that expenditure is, relative to the company's market value, we think there's an elevated risk of funding distress, and we would be very nervous about holding the stock.

How Risky Is Aligos Therapeutics' Cash Burn Situation?

On this analysis of Aligos Therapeutics' cash burn, we think its cash runway was reassuring, while its cash burn relative to its market cap has us a bit worried. After looking at that range of measures, we think shareholders should be extremely attentive to how the company is using its cash, as the cash burn makes us uncomfortable. On another note, Aligos Therapeutics has 5 warning signs (and 2 which make us uncomfortable) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies with significant insider holdings, and this list of stocks growth stocks (according to analyst forecasts)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.