Each week, Benzinga's Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week ending May 9:

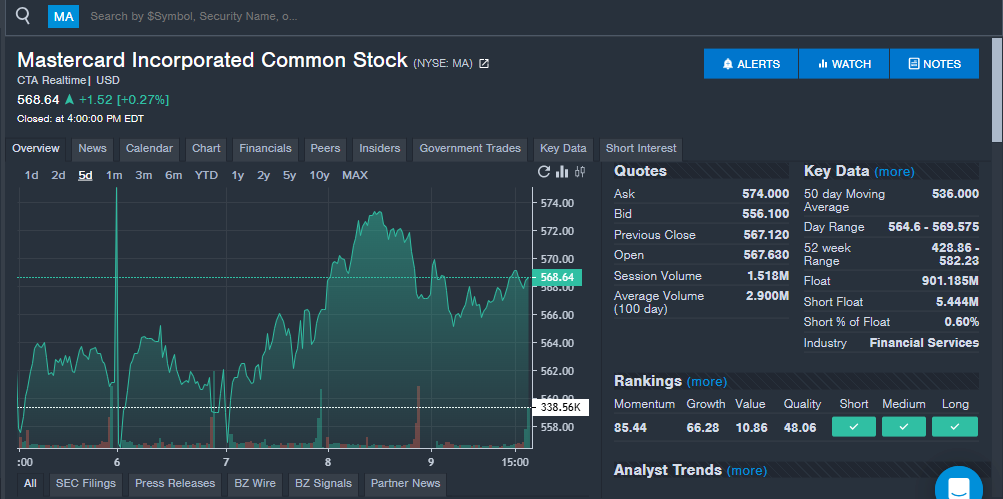

Mastercard Inc (NYSE:MA): The payment processing and credit card company saw strong interest from Benzinga readers during the week, which comes after the company reported first-quarter financial results. Mastercard reported quarterly revenue of $7.25 billion and earnings per share of $3.73. Both figures beat Street estimates, continuing a streak of both figures beating estimates for more than 10 straight quarters. Among the highlights in the quarter was cross-border volume that was up 15% year-over-year. The company announced a partnership with Corpay in the quarter that will further help with cross-border payment solutions. JPMorgan analyst Tien-tsin Huang reiterated an Overweight rating on the stock after earnings. The analyst said the company showed stability despite headwinds.

The stock was up around 2% during the week as seen on the Benzinga Pro chart below with the stock up 25% over the last year.

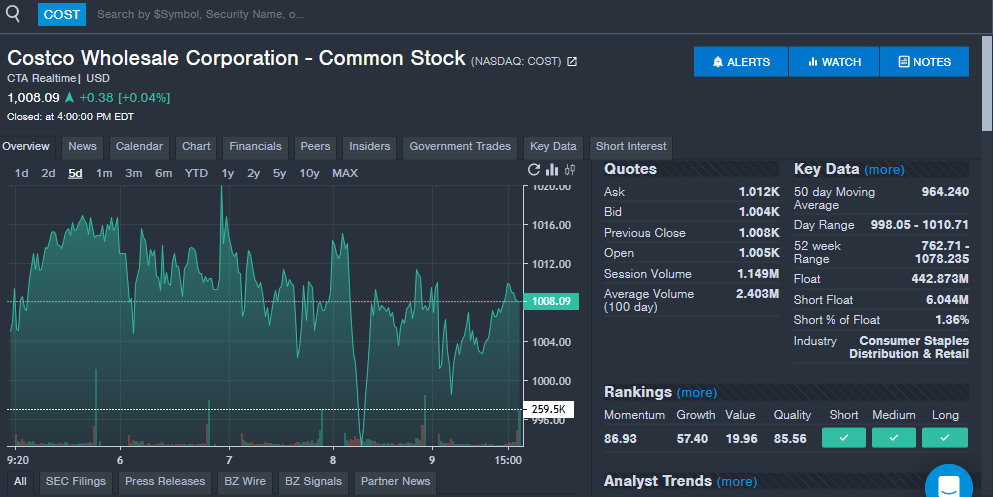

Costco Wholesale Corporation (NASDAQ:COST): The retailer saw increased interest from readers during the week, which comes with April comparable monthly sales reported and as the company prepares for third-quarter financial results. The company reported April monthly sales of $21.2 billion, up 7% year-over-year. Comparable store sales were up 5.2% year-over-year in U.S. locations during the month, while overall same store sales increased 4.4% year-over-year. Analysts expect the company to post third-quarter revenue of $63.0 billion, up from $58.5 billion. The company has missed revenue estimates in six of the last 10 quarters. Increased attention to the stock could indicate more optimism for the next report with macro concerns and tariffs leading to an increase in bulk shopping during recent months.

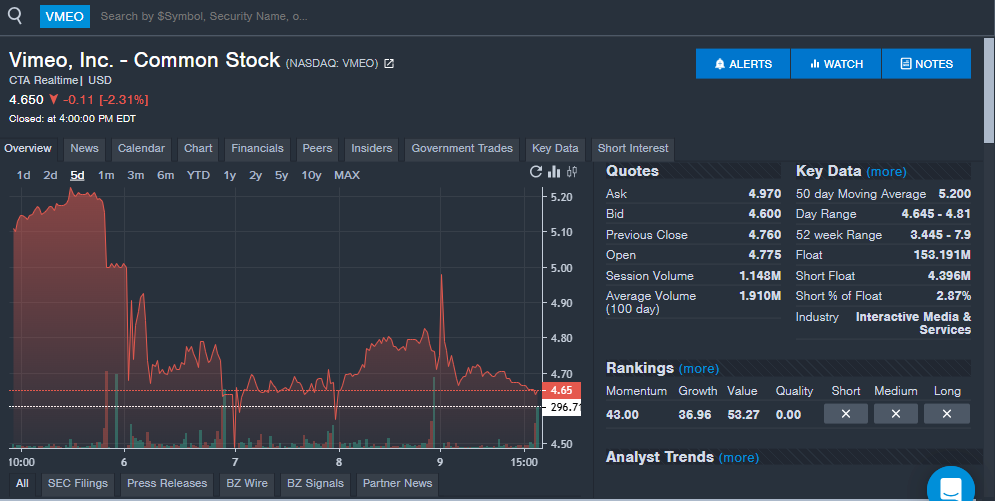

Vimeo Inc (NASDAQ:VMEO): The video software company saw increased interest from readers during the week, as shares declined after first-quarter results. The company beat analyst estimates for both revenue and earnings per share in the quarter. Vimeo has beaten analyst estimates for earnings per share in nine of the last 10 quarters and for revenue in more than 10 straight quarters. In the earnings report, the company highlighted price increases and strength of self-serve bookings. Vimeo Enterprise also was highlighted with revenue up 32% year-over-year. The company also said it was investing for growth and highlighted new AI tools and the new Vimeo Streaming product.

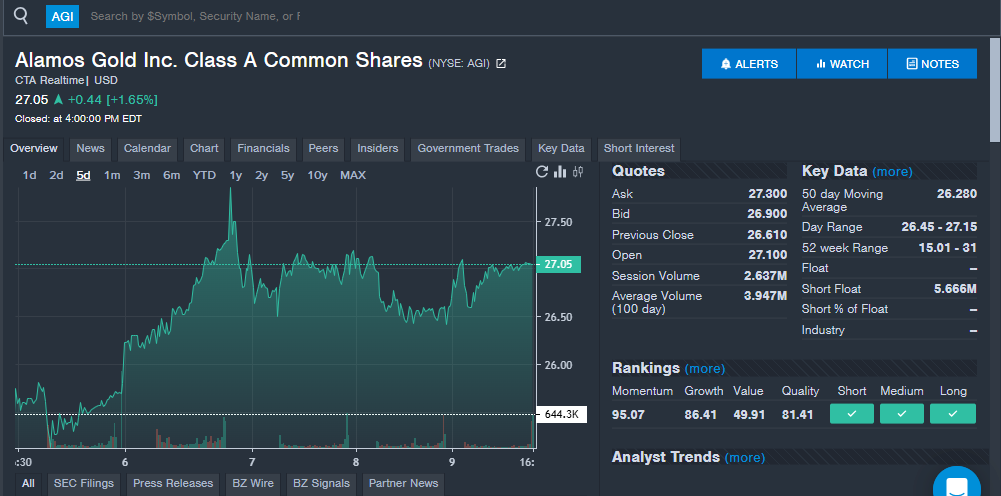

Alamos Gold Inc (NYSE:AGI): Alamos Gold reappears on the Stock Whisper Index for a second straight month with gold stocks continuing to see strong interest from readers. The company reported first-quarter financial results on April 30 with revenue and earnings per share missing analyst estimates. The company has beaten estimates in these figures in eight and seven of the last 10 quarters respectively. Alamos produced 125,000 ounces of gold in the quarter, which was at the low end of company guidance. The company said it continues to work towards stronger production with an aim of a run rate of one million ounces per year in the coming years.

"Nearly all of this growth is in Canada, it's all lower cost, and it's all fully funded providing one of the strongest outlooks in our sector," Alamos Gold CEO John McCluskey said after the quarterly results when talking of future growth.

Accenture Plc (NYSE:ACN): The IT services company saw strong interest from readers during the week on the heels of two acquisition announcements. On May 6, the company announced it was acquiring Ascendient Learning to expand its learning and certification capabilities. The company said the acquisition expands the number of certification offerings, enhances instructor-led training and adds upskilling programs. On May 8, the company announced the acquisition of Japanese digital services company Yumemi. The company said the acquisition will enhance capabilities to design and launch products for clients. Yumemi has designed digital products for more than 600 companies since its founding in 2000. Accenture is expected to report third-quarter financial results in June. The company has beaten analyst estimates for earnings per share in nine of the last 10 quarters and beaten revenue estimates in seven of the last 10 quarters.

Stay tuned for next week's report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next: