Capital One Financial (NYSE:COF) recently announced a series of dividends for both common and preferred stocks, reaffirming its consistent return of value to shareholders, as evidenced by its longstanding dividend payments since 1995. Over the past month, the company's stock experienced a significant price move of 24%, potentially influenced by this announcement. During this time, the broader market, which showed a minor upward trend of just over 1%, was marked by investor anticipation surrounding US-China tariff talks and minor fluctuations following Federal Reserve announcements. The sector's positive earnings outlook and favorable dividend news may have supported Capital One’s remarkable price trajectory.

Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

The recent dividend announcement by Capital One Financial plays a crucial role in enhancing shareholder value, not just in the short term but also as part of a long-standing tradition since 1995. Over the last five years, the company delivered a total return of 248.01%, illustrating its capacity to generate significant value for its shareholders over a longer horizon. The stock's recent 24% surge against a modest market rise of just over 1% suggests a strong reaction to this dividend news, alongside an improved sector and earnings outlook.

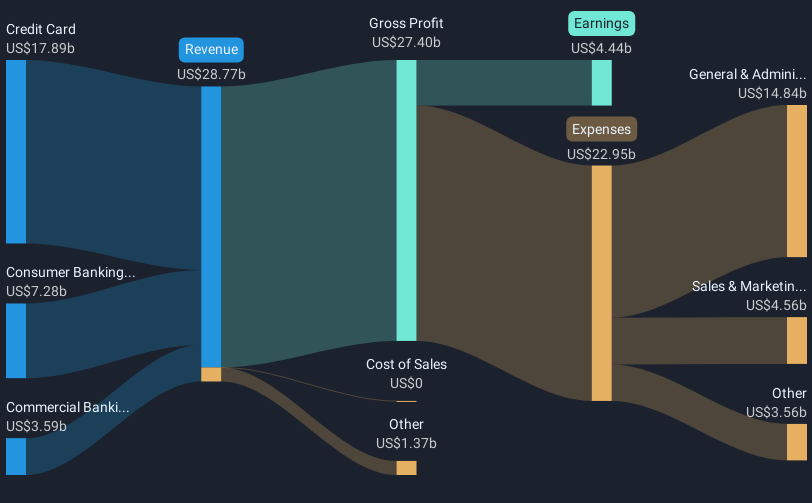

The integration of Discover is anticipated to impact Capital One's revenue and earnings forecasts positively by creating a robust consumer banking and payments platform. The potential revenue growth, coupled with strategic marketing investments, could be influential in achieving the analysts’ consensus price target of US$211.20, which is 12.1% higher than the current share price of US$185.71. However, noted risks such as rising operational costs and the end of significant agreements underscore the importance of closely monitoring changes in financial metrics, such as charge-off rates, which have increased to 6.19% recently.

Compared to the broader 8.2% market return over the past year, Capital One's recent performance has significantly outpaced both the market and the US Consumer Finance industry, which saw a 22.1% increase. The combination of dividends and strategic acquisitions could meaningfully enhance the company's earnings trajectory, aiding in the fulfillment of future forecasts, which estimate a potential earnings growth to US$9.5 billion by May 2028. Given these developments, stakeholders should consider the potential and risks attached to the projected growth in both the revenue and earnings domains.

Dive into the specifics of Capital One Financial here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com