Coeur Mining (NYSE:CDE) experienced a significant price increase of 45% over the past month, which aligns with strong recent performance indicators. The company's Q1 earnings report revealed a striking turnaround, with sales jumping to USD 360 million from USD 213 million, and a move from a net loss to a net income of USD 33 million year-over-year. Additionally, gold and silver production boosted, reinforcing Coeur’s productive capacity. These strong internal developments occur amid a volatile market where major indexes saw mixed movements due to ongoing tariff talks, suggesting that Coeur's robust performance markedly supported its stock price rise amidst a broader market upturn.

Over a longer period, Coeur Mining has achieved a total shareholder return of 124.84% over the past three years. This reflects an impressive gain that outpaced both the overall US market and the US Metals and Mining industry’s one-year returns, which stood at 8.2% and a decline of 4.8%, respectively.

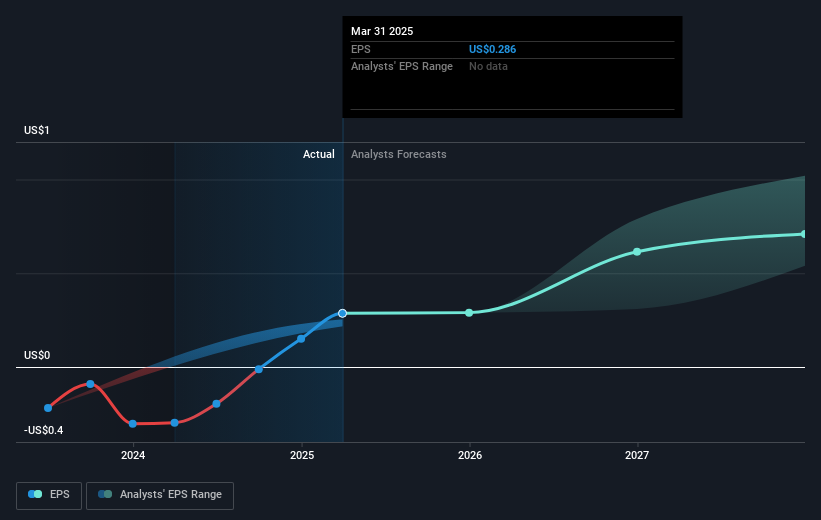

The recent developments outlined, including the significant rise in Q1 earnings and increased production capacities, suggest potential positive impacts on future revenue and earnings forecasts. The company's efforts in improving its gold and silver output align with the forecasted growth rates which surpass both revenue and earnings expectations in the broader market. Coeur's management diligence, reflected in improved operating metrics, could sustain these upward trends.

Despite an upward price movement, Coeur's current trading price at US$6.97 remains below the consensus analyst price target of US$9.67, indicating room for potential appreciation. This underscores continued investor interest in aligning market prices closer to perceived fair values, provided the company maintains its operational momentum and market conditions remain favorable.

Evaluate Coeur Mining's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com