Johnson & Johnson (NYSE:JNJ) recently announced promising Phase 3 results for icotrokinra, a new investigational treatment for psoriasis, while facing legal challenges from a jury awarding a $3 million verdict linked to baby powder use. These developments coincided with a 3.77% rise in the company's stock over the past month. This price movement reflects broader market trends, as the Dow Jones was relatively flat amid ongoing U.S.-China tariff discussions. Johnson & Johnson's positive earnings report and dividend increase likely added weight to the company's price gains, aligning with overall market stability.

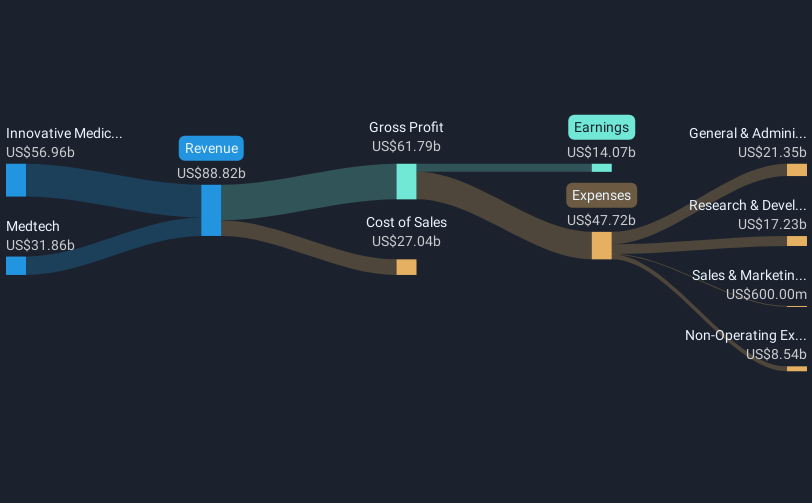

The recent announcement of Johnson & Johnson's promising Phase 3 results for its investigational psoriasis treatment, icotrokinra, offers potential growth opportunities in its Innovative Medicine sector. This could positively influence revenue and earnings forecasts, potentially offsetting challenges such as the loss of exclusivity for STELARA. The company's previous strategic investments and expansion initiatives, especially in MedTech, aim to buffer these headwinds, leveraging their substantial investment in the U.S. to foster operational efficiency.

Over the past five years, Johnson & Johnson's total shareholder return, including share price and dividends, was 21.32%. This contrasts its performance against the past year's underperformance, where the company lagged behind the US market's 8.2% growth while exceeding the Pharmaceuticals industry's negative 8.8% return. Analysts' consensus price target of US$169.98 reflects a 9.1% potential upside from the current share price, suggesting room for growth, assuming revenue and earnings projections materialize. Recent litigation outcomes, like the $3 million verdict associated with baby powder, continue to pose financial risks but have thus far been outweighed by positive developments and earnings support.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com