Teradyne (NasdaqGS:TER) recently affirmed its quarterly dividend of $0.12 per share, payable in June 2025, signaling stability to its shareholders. Over the past month, Teradyne's share price rose by 13%, which aligns with its positive earnings performance for Q1 2025, including a sales increase to $686 million. The company also announced a $1 billion share repurchase program, contributing to investor confidence. Despite broader market fluctuations, such as the S&P 500's decline, Teradyne's solid earnings and shareholder-focused strategies likely supported its stock's upward trajectory along with the market’s positive return in recent weeks.

Buy, Hold or Sell Teradyne? View our complete analysis and fair value estimate and you decide.

The recent affirmation of Teradyne's quarterly dividend and the announcement of a $1 billion share repurchase program demonstrate the company's commitment to returning value to shareholders, which may bolster investor confidence and contribute to its recent share price increase. This aligns with the company's strategic focus on AI, robotics, and semiconductor automation as growth drivers. Such initiatives aim to enhance future revenue and net margins, thereby positively influencing future earnings forecasts.

Over a five-year period, Teradyne shares delivered a total return of 27.77%, reflecting a longer-term growth trajectory despite more recent market fluctuations. This contrasts with the company's performance over the past year, where it underperformed the US Semiconductor industry, which had a 13.8% return, and the broader US market, with an 8.2% return.

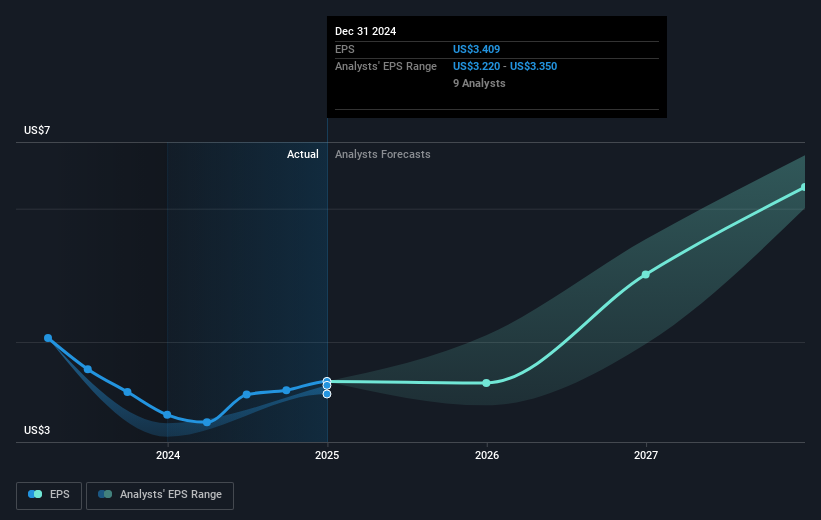

Regarding revenue and earnings forecasts, the focus on advancing technologies and expansion in AI and semiconductor domains indicates potential growth areas. Analysts project annual revenue growth at 12.3% and profit margin improvements. The recent news aligns with these forecasts, although external factors such as tariffs and geopolitical tensions could challenge these projections.

The current share price, having risen significantly, is at a discount when compared to the consensus analyst price target of US$99.83. This implies that if the company's future earnings and strategic plans align with analyst expectations, there could be further upside potential. However, investors should be mindful of factors like projected share count growth and ongoing economic uncertainties that might affect these targets.

Explore Teradyne's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com