Teekay Tankers Ltd. (NYSE:TNK) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

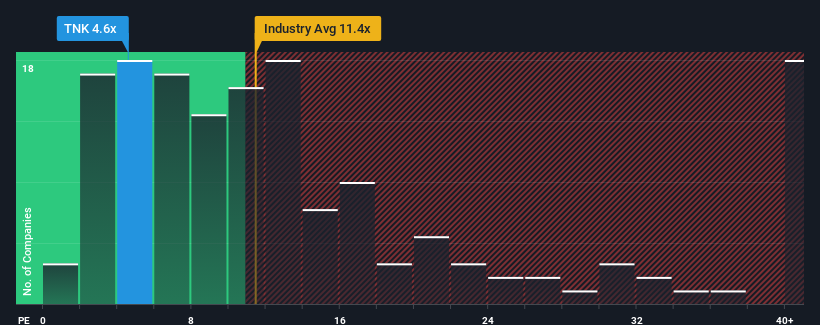

Although its price has surged higher, Teekay Tankers' price-to-earnings (or "P/E") ratio of 4.6x might still make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 18x and even P/E's above 32x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Teekay Tankers' earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Teekay Tankers

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Teekay Tankers would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 33%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 0.6% each year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the market is forecast to expand by 10% per year, which is noticeably more attractive.

In light of this, it's understandable that Teekay Tankers' P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Teekay Tankers' recent share price jump still sees its P/E sitting firmly flat on the ground. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Teekay Tankers maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Teekay Tankers is showing 3 warning signs in our investment analysis, and 1 of those is a bit concerning.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.