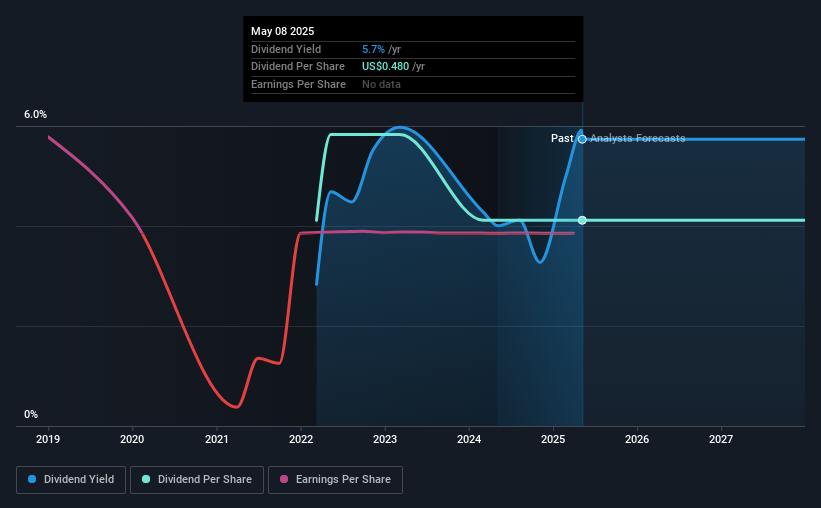

The board of Crescent Energy Company (NYSE:CRGY) has announced that it will pay a dividend on the 2nd of June, with investors receiving $0.12 per share. This makes the dividend yield 5.7%, which will augment investor returns quite nicely.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Crescent Energy's stock price has reduced by 43% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

Estimates Indicate Crescent Energy's Dividend Coverage Likely To Improve

A big dividend yield for a few years doesn't mean much if it can't be sustained. Even though Crescent Energy is not generating a profit, it is still paying a dividend. It is also not generating any free cash flow, we definitely have concerns when it comes to the sustainability of the dividend.

Looking forward, earnings per share is forecast to rise exponentially over the next year. Assuming the dividend continues along recent trends, we think the payout ratio will be 40%, which makes us pretty comfortable with the sustainability of the dividend.

Check out our latest analysis for Crescent Energy

Crescent Energy's Dividend Has Lacked Consistency

Looking back, the dividend has been unstable but with a relatively short history, we think it may be a bit early to draw conclusions about long term dividend sustainability. The last annual payment of $0.48 was flat on the annual payment from3 years ago. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

The Company Could Face Some Challenges Growing The Dividend

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. It's encouraging to see that Crescent Energy has been growing its earnings per share at 116% a year over the past five years. Even though the company is not profitable, it is growing at a solid clip. If the company can turn a profit relatively soon, we can see this becoming a reliable income stock.

An additional note is that the company has been raising capital by issuing stock equal to 44% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

The Dividend Could Prove To Be Unreliable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Crescent Energy's payments, as there could be some issues with sustaining them into the future. Strong earnings growth means Crescent Energy has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. We don't think Crescent Energy is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 2 warning signs for Crescent Energy that you should be aware of before investing. Is Crescent Energy not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.