Those holding IREN Limited (NASDAQ:IREN) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last 30 days bring the annual gain to a very sharp 35%.

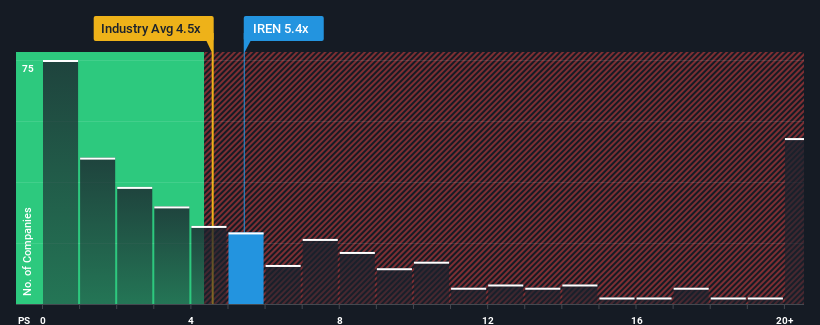

In spite of the firm bounce in price, there still wouldn't be many who think IREN's price-to-sales (or "P/S") ratio of 5.4x is worth a mention when the median P/S in the United States' Software industry is similar at about 4.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for IREN

What Does IREN's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, IREN has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think IREN's future stacks up against the industry? In that case, our free report is a great place to start.How Is IREN's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like IREN's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 133%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 140% during the coming year according to the twelve analysts following the company. That's shaping up to be materially higher than the 15% growth forecast for the broader industry.

With this in consideration, we find it intriguing that IREN's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does IREN's P/S Mean For Investors?

Its shares have lifted substantially and now IREN's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that IREN currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 2 warning signs for IREN (1 can't be ignored!) that we have uncovered.

If these risks are making you reconsider your opinion on IREN, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.