Despite an already strong run, Shanghai Chicmax Cosmetic Co., Ltd. (HKG:2145) shares have been powering on, with a gain of 49% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 26% in the last year.

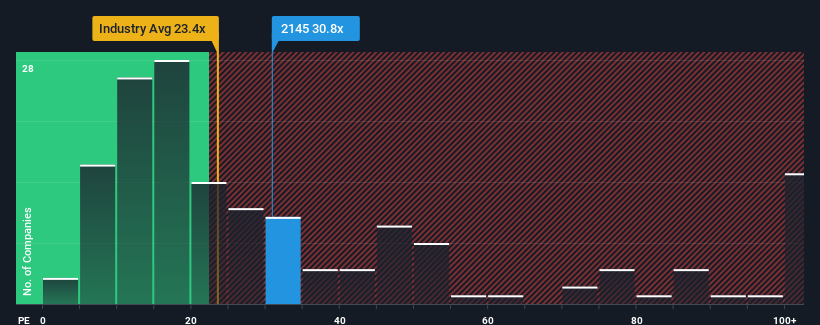

Since its price has surged higher, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 10x, you may consider Shanghai Chicmax Cosmetic as a stock to avoid entirely with its 30.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

We've discovered 1 warning sign about Shanghai Chicmax Cosmetic. View them for free.Recent times have been advantageous for Shanghai Chicmax Cosmetic as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Shanghai Chicmax Cosmetic

Does Growth Match The High P/E?

In order to justify its P/E ratio, Shanghai Chicmax Cosmetic would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 69%. The strong recent performance means it was also able to grow EPS by 108% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 26% each year as estimated by the eight analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 15% each year, which is noticeably less attractive.

In light of this, it's understandable that Shanghai Chicmax Cosmetic's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Shanghai Chicmax Cosmetic's P/E?

Shares in Shanghai Chicmax Cosmetic have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Shanghai Chicmax Cosmetic's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Shanghai Chicmax Cosmetic.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.