As global markets navigate through easing trade tensions and mixed economic signals, the Asian tech sector continues to capture investor interest with its potential for high growth amidst a backdrop of cautious optimism. In this environment, identifying promising stocks often involves looking at companies that demonstrate resilience and adaptability in the face of economic uncertainties, particularly those that leverage innovation to drive growth.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 28.00% | 28.07% | ★★★★★★ |

| Eoptolink Technology | 26.83% | 26.04% | ★★★★★★ |

| Fositek | 29.05% | 34.17% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 28.34% | 29.48% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| PharmaEssentia | 32.31% | 59.75% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 21.74% | 25.00% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

FIT Hon Teng (SEHK:6088)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FIT Hon Teng Limited is a company that manufactures and sells mobile and wireless devices and connectors both in Taiwan and internationally, with a market capitalization of approximately HK$15.04 billion.

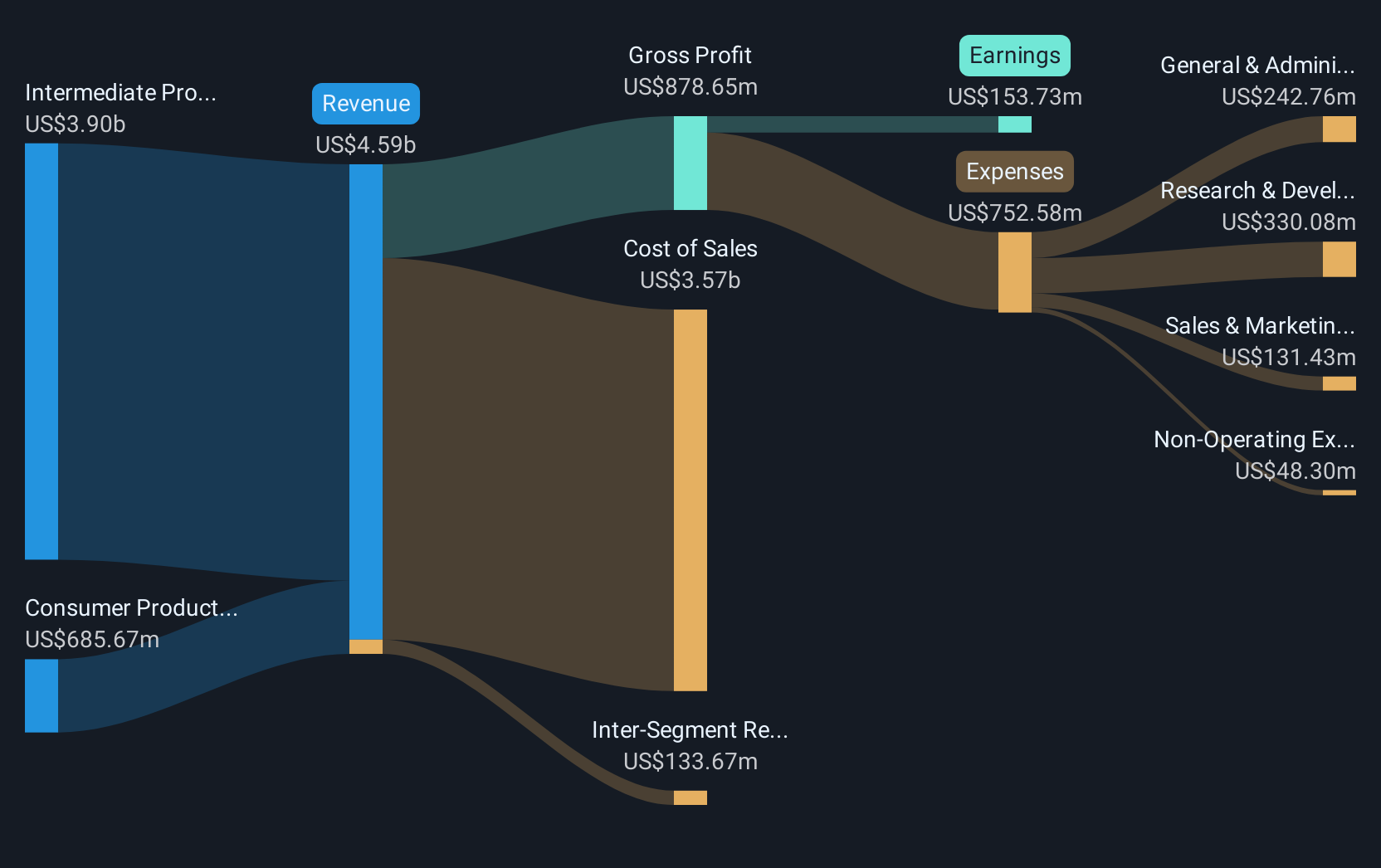

Operations: FIT Hon Teng Limited generates revenue primarily from two segments: Consumer Products, contributing $685.67 million, and Intermediate Products, contributing $3.90 billion. The company's operations span both Taiwan and international markets, focusing on mobile and wireless devices and connectors.

FIT Hon Teng has demonstrated a robust performance with a 19.2% increase in earnings last year, outpacing the electronics industry's growth of 17.1%. This growth is supported by significant R&D investments, aligning with its revenue increase of 11.9% annually, which surpasses the Hong Kong market average of 8.5%. Despite challenges like a highly volatile share price and low forecasted Return on Equity at 9%, the company's strategic focus on innovation through R&D (spending figures not specified) positions it well for future technological advancements and market demands. The recent financial results underscore its potential, reporting a rise in sales to $4.45 billion from $4.20 billion year-over-year and an increase in net income to $153.73 million from $128.97 million, reflecting strong operational execution and market adaptation.

- Get an in-depth perspective on FIT Hon Teng's performance by reading our health report here.

Understand FIT Hon Teng's track record by examining our Past report.

Sun Create Electronics (SHSE:600990)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sun Create Electronics Co., Ltd focuses on the research and development, design, manufacture, and marketing of radar and security systems with a market cap of approximately CN¥6.07 billion.

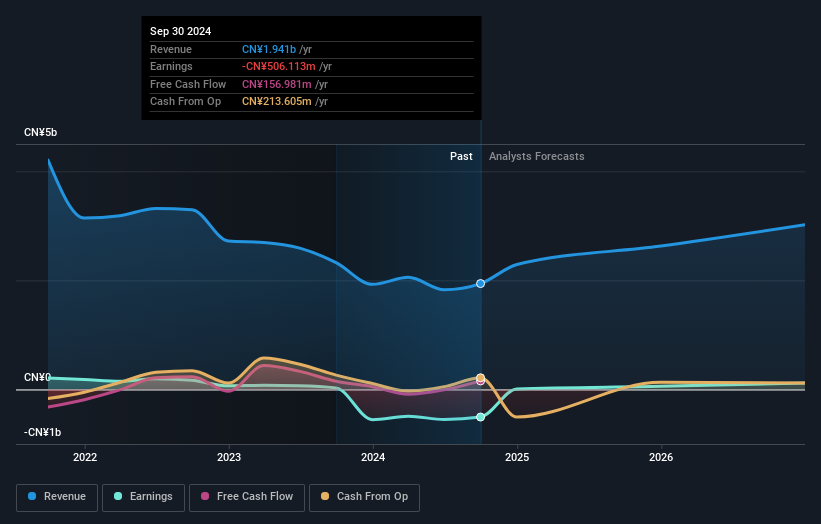

Operations: The company generates revenue primarily from its electronic industry segment, amounting to approximately CN¥1.60 billion.

Despite recent setbacks in earnings, Sun Create Electronics demonstrates potential for recovery with a forecasted annual revenue growth of 29.3%, which significantly outpaces the Chinese market average of 12.6%. The firm's commitment to R&D is evident from its strategy to pivot towards profitability within three years, suggesting an aggressive approach to innovation and market adaptation. While currently unprofitable, the projected earnings growth of nearly 130% per year could position it favorably against industry norms, especially as it moves towards positive cash flow dynamics. This trajectory indicates a promising future if the company can effectively manage its financial health and continue to innovate in high-growth tech sectors in Asia.

Thunder Software TechnologyLtd (SZSE:300496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Thunder Software Technology Co., Ltd. is a company that specializes in providing operating-system products across various regions including China, Europe, the United States, and Japan, with a market capitalization of approximately CN¥26.75 billion.

Operations: Thunder Software Technology Co., Ltd. generates revenue primarily from its operating-system products, serving markets in China, Europe, the United States, Japan, and other international regions. The company has a market capitalization of about CN¥26.75 billion.

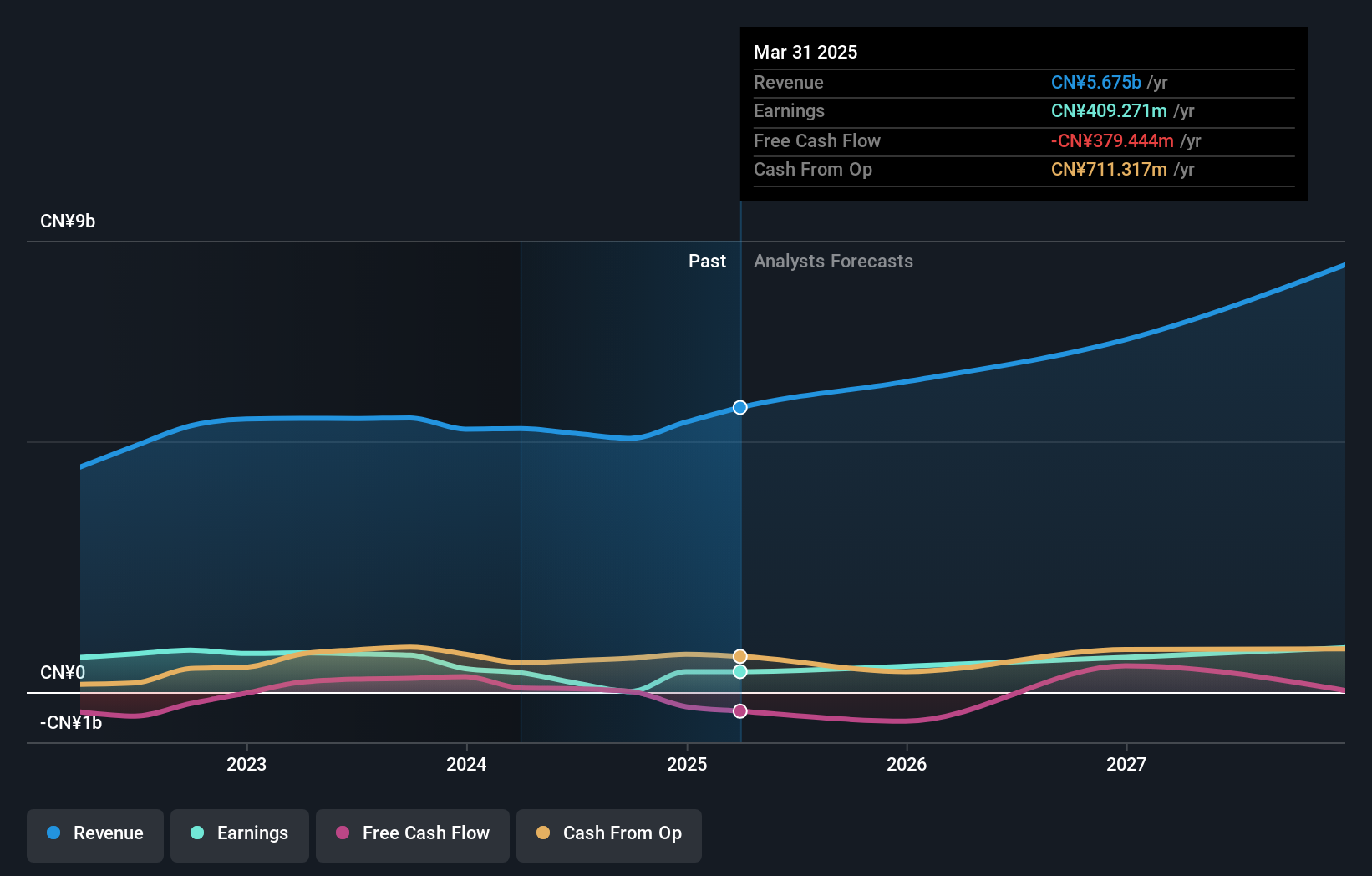

Thunder Software Technology Co., Ltd. has demonstrated robust financial performance with a notable increase in annual revenue, rising to CNY 5.38 billion, up from CNY 5.24 billion the previous year, reflecting a growth of 12.9%. This growth is complemented by an aggressive R&D investment strategy, allocating significant resources to innovation—evident from its recent earnings report detailing R&D expenses amounting to CNY 407.46 million. The company's strategic focus on software solutions and integration services for the automotive and mobile industries positions it well within the high-growth tech sector in Asia, despite a slight dip in net income year-over-year to CNY 407.46 million from CNY 466.19 million.

Taking Advantage

- Embark on your investment journey to our 481 Asian High Growth Tech and AI Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com