5 analysts have expressed a variety of opinions on Verisk Analytics (NASDAQ:VRSK) over the past quarter, offering a diverse set of opinions from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 4 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 3 | 1 | 0 | 0 |

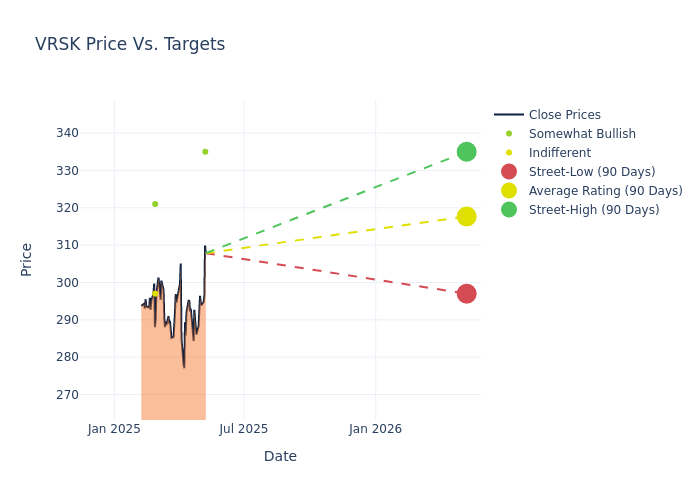

Analysts have recently evaluated Verisk Analytics and provided 12-month price targets. The average target is $319.6, accompanied by a high estimate of $335.00 and a low estimate of $297.00. Witnessing a positive shift, the current average has risen by 4.04% from the previous average price target of $307.20.

Decoding Analyst Ratings: A Detailed Look

The analysis of recent analyst actions sheds light on the perception of Verisk Analytics by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jeffrey Meuler | Baird | Raises | Outperform | $335.00 | $320.00 |

| Jason Haas | Wells Fargo | Lowers | Overweight | $321.00 | $325.00 |

| Jeffrey Silber | BMO Capital | Raises | Market Perform | $297.00 | $280.00 |

| Jeffrey Meuler | Baird | Raises | Outperform | $320.00 | $298.00 |

| Jason Haas | Wells Fargo | Raises | Overweight | $325.00 | $313.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Verisk Analytics. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Verisk Analytics compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Verisk Analytics's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Verisk Analytics's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Verisk Analytics analyst ratings.

Get to Know Verisk Analytics Better

Verisk Analytics is the leading provider of statistical, actuarial, and underwriting data for the United States' property and casualty insurance industry. Verisk leverages a vast contributory database and proprietary data assets to develop analytical tools helping insurance providers to better assess and price risk, achieve operational efficiency and optimize claim settlement processes. While Verisk also offers tools to quantify costs after loss events occur and to detect fraudulent activity, it is expanding into adjacent markets of life insurance, marketing, and non-US operations.

A Deep Dive into Verisk Analytics's Financials

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Verisk Analytics's remarkable performance in 3M is evident. As of 31 December, 2024, the company achieved an impressive revenue growth rate of 8.62%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: Verisk Analytics's net margin excels beyond industry benchmarks, reaching 28.59%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 105.23%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Verisk Analytics's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 4.76%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a high debt-to-equity ratio of 32.43, Verisk Analytics faces challenges in effectively managing its debt levels, indicating potential financial strain.

Understanding the Relevance of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.