In the last three months, 10 analysts have published ratings on Dollar General (NYSE:DG), offering a diverse range of perspectives from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 0 | 6 | 0 | 1 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 1 | 0 | 3 | 0 | 0 |

| 3M Ago | 1 | 0 | 2 | 0 | 1 |

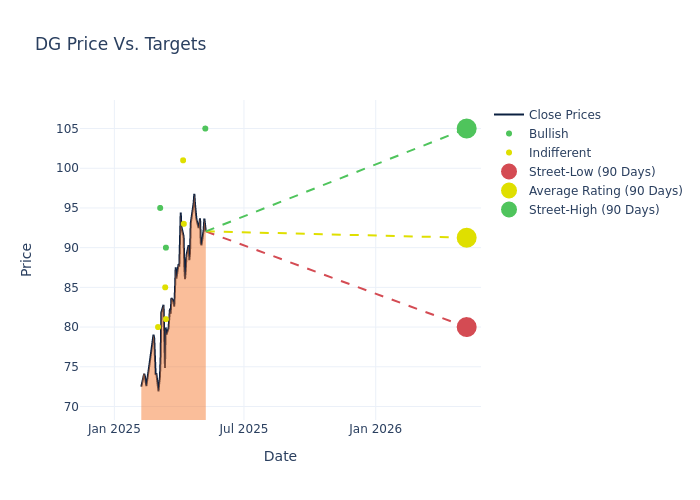

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $88.4, a high estimate of $105.00, and a low estimate of $69.00. Marking an increase of 2.43%, the current average surpasses the previous average price target of $86.30.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of Dollar General's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| John Heinbockel | Guggenheim | Raises | Buy | $105.00 | $100.00 |

| Scot Ciccarelli | Truist Securities | Raises | Hold | $93.00 | $76.00 |

| Paul Lejuez | Citigroup | Raises | Neutral | $101.00 | $69.00 |

| Peter Keith | Piper Sandler | Raises | Neutral | $81.00 | $79.00 |

| Robert Ohmes | B of A Securities | Lowers | Buy | $90.00 | $95.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Market Perform | $85.00 | $85.00 |

| Paul Lejuez | Citigroup | Lowers | Sell | $69.00 | $73.00 |

| Michael Lasser | UBS | Lowers | Buy | $95.00 | $108.00 |

| Joseph Feldman | Telsey Advisory Group | Lowers | Market Perform | $85.00 | $88.00 |

| Krisztina Katai | Deutsche Bank | Lowers | Hold | $80.00 | $90.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Dollar General. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Dollar General compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

To gain a panoramic view of Dollar General's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Dollar General analyst ratings.

All You Need to Know About Dollar General

With more than 20,000 locations, Dollar General's banner is nearly ubiquitous across the rural United States. Dollar General serves as a convenient shopping destination for fill-in store trips, with its value proposition most relevant to consumers in small communities with a dearth of shopping options. The retailer operates a frugal store of about 7,500 square feet and primarily offers an assortment of branded and private-label consumable items (80% of net sales) such as paper and cleaning products, packaged food, and health and beauty items at low prices. Dollar General also offers a limited assortment of seasonal merchandise, home products, and apparel. The firm sells most items at a price point of $10 or less.

A Deep Dive into Dollar General's Financials

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Dollar General's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 4.52% as of 31 January, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Staples sector.

Net Margin: Dollar General's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 1.86%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Dollar General's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.59%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.61%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Dollar General's debt-to-equity ratio stands notably higher than the industry average, reaching 2.36. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Significance of Analyst Ratings Explained

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.