Honeywell International (NasdaqGS:HON) recently signed a significant long-term agreement with Vertical Aerospace, focusing on the certification and production of electric VTOL aircraft systems. This partnership likely supported the company's 14% price increase over the past month. Additionally, Honeywell's share buyback and raised earnings guidance could have provided a strong foundation for investor confidence. While broader market trends showed a slight uptrend over the same period, these specific corporate events potentially accentuated Honeywell's stock performance, aligning with the upsurge noted in other U.S. stocks following positive trade and economic developments.

The recent deal between Honeywell International and Vertical Aerospace could significantly influence the company's strategic direction, particularly in the aerospace segment. By focusing on electric VTOL aircraft systems, Honeywell may enhance its technological edge, potentially driving future revenue and earnings growth. Over the past five years, Honeywell's total shareholder return, including dividends, reached 93.53%, highlighting strong long-term performance. However, this positive trend contrasts with the past year's underperformance against the US Industrials industry, which returned 14.7% compared to Honeywell's 7.7% gain.

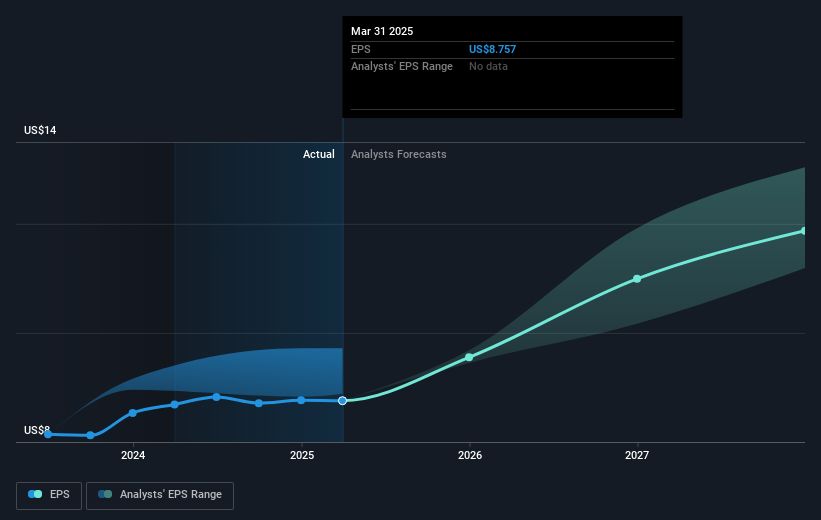

Incorporating this new collaboration into growth forecasts, analysts might revise their revenue and earnings projections upward due to potential increased demand in the aerospace sector. Nonetheless, the company's planned separation into three entities and tariff pressures pose challenges, impacting margins and earnings sustainability. With a current share price of US$209.93 and a consensus price target of approximately US$235.60, there's room for potential appreciation should Honeywell's strategies prove successful against broader economic vulnerabilities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com