Parker-Hannifin's (NYSE:PH) recent leadership transition announcement involving the incoming presidency of Matthew A. Jacobson over the Filtration Group is a significant development that may align with the company's broader strategic goals. Over the last month, the company's stock price increased by 17%, a notable move that stands out compared to the general market's 1.2% gain in the same period. This surge may be further supported by a robust earnings report revealing higher net income and rising earnings per share, alongside a dividend increase and share buybacks. Consequently, these elements have likely reinforced investor confidence during an era of favorable market trends enhanced by positive trade developments.

Find companies with promising cash flow potential yet trading below their fair value.

The leadership transition at Parker-Hannifin, with Matthew A. Jacobson's appointment as president over the Filtration Group, aligns with the company's focus on pivotal business segments. This development reflects ongoing efforts to consolidate market presence through strategic acquisitions, which have historically enhanced revenue growth and fortified its aerospace and filtration businesses. As of 8 May 2025, Parker-Hannifin's impressive five-year total return of 354.13% underscores its robust performance relative to the broader market trends.

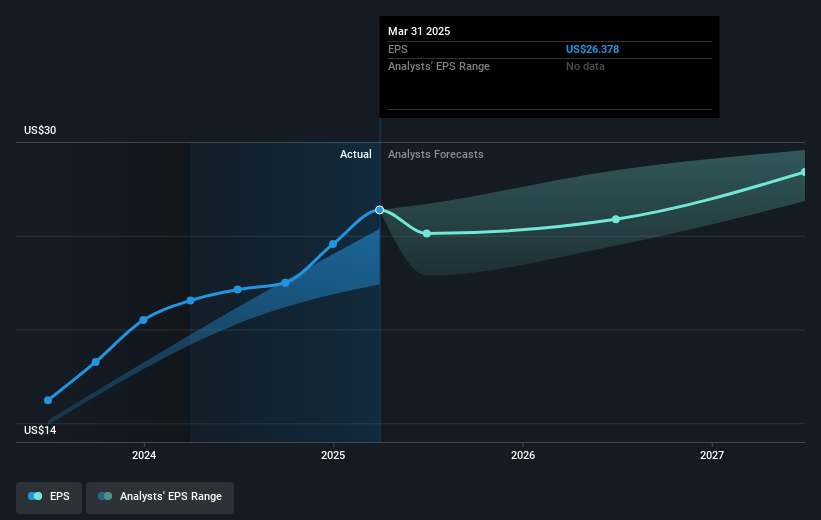

In comparison, over the past year, Parker-Hannifin outperformed both the US Machinery industry and the general market, with the market showing a 7.7% return while the Machinery industry lost 3.8%. The company's consistent focus on cost control, margin expansion, and strategic acquisitions supports its current operational and financial robustness. The price movement, with a 17% increase in a month, indicates favorable investor sentiment, aligning closely with the consensus analyst price target of US$704.38, which is approximately 12.8% higher than the current share price.

Looking ahead, the recent leadership adjustment may influence revenue and earnings forecasts positively through enhanced business segment performance and continued implementation of efficiency measures. However, the ongoing global industrial recovery and market dynamics will play a critical role in validating these forecasts. As analysts expect earnings to reach US$3.7 billion by May 2028, the market's reaction to new executive strategies will be crucial in achieving these financial projections.

The valuation report we've compiled suggests that Parker-Hannifin's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com