United Parcel Service (NYSE:UPS) recently affirmed its regular quarterly dividend of $1.64 per share, maintaining investor confidence despite a 1% decline in its stock price over the past week. While UPS shares showed a minor decrease, broader market indices such as the Dow Jones and S&P 500 experienced gains, driven by favorable trade developments between the U.S. and U.K. The affirmation of the dividend may have provided a stable backdrop for UPS amidst these market fluctuations. Overall, UPS's minor decline contrasts with the positive market sentiment fueled by external macroeconomic news.

Find companies with promising cash flow potential yet trading below their fair value.

The affirmation of UPS's quarterly dividend amidst recent share price weakness highlights the firm's commitment to returning value to its shareholders. Over the past five years, UPS delivered a total return of 23.60%, reflecting the resilience of its business model despite short-term stock fluctuations. In the past year, however, UPS underperformed the US logistics industry, which declined by 25.20%, pointing to potential challenges in maintaining competitive momentum.

The recent dividend announcement may bolster investor confidence by providing a dependable income stream, even as UPS shares currently trade at a discount to the consensus price target of US$116.91. This gap suggests potential upside if the company's strategic initiatives, such as automation and e-commerce expansion, materialize effectively this year.

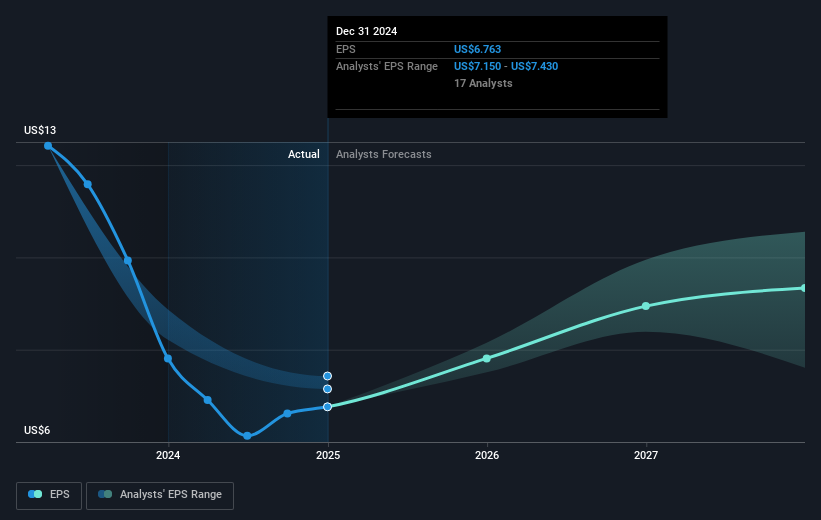

The continued emphasis on e-commerce and automation could positively influence revenue and earnings forecasts. Analysts project an annual revenue growth of 1.7% and an increase in profit margins to 8.00% by 2028, setting the stage for expected earnings of US$7.6 billion. However, varying macroeconomic factors and logistics industry trends mean investors should consider a range of outcomes.

Overall, while recent macroeconomic news and the dividend affirmation present a stable horizon for UPS, weighing these against industry dynamics and the broader market context is crucial for assessing future performance and potential market value realization.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com