It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in EFT Solutions Holdings (HKG:8062). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Our free stock report includes 2 warning signs investors should be aware of before investing in EFT Solutions Holdings. Read for free now.How Quickly Is EFT Solutions Holdings Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. EFT Solutions Holdings managed to grow EPS by 6.6% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that EFT Solutions Holdings is growing revenues, and EBIT margins improved by 6.4 percentage points to 27%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

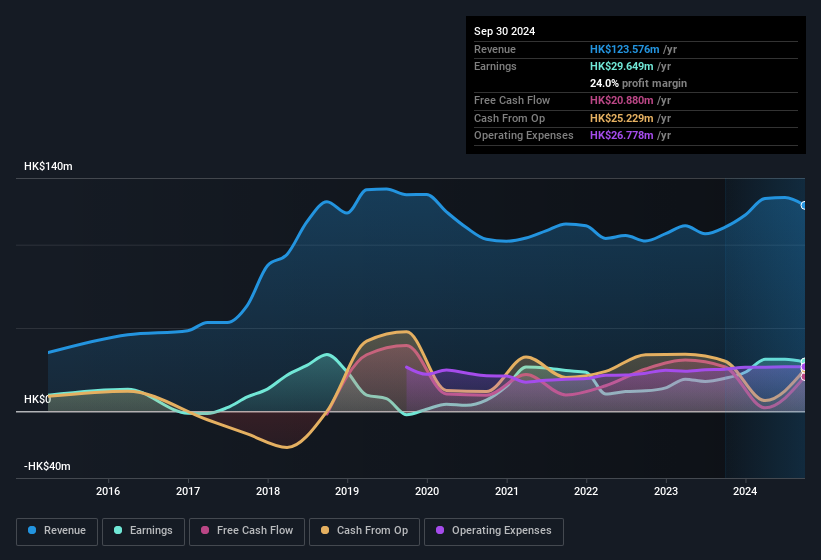

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

View our latest analysis for EFT Solutions Holdings

EFT Solutions Holdings isn't a huge company, given its market capitalisation of HK$149m. That makes it extra important to check on its balance sheet strength.

Are EFT Solutions Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The first bit of good news is that no EFT Solutions Holdings insiders reported share sales in the last twelve months. But the really good news is that Chief Compliance Officer Chun Kit Lo spent HK$1.6m buying stock, at an average price of around HK$0.31. It seems at least one insider thinks that the company is doing well - and they are backing that view with cash.

And the insider buying isn't the only sign of alignment between shareholders and the board, since EFT Solutions Holdings insiders own more than a third of the company. To be exact, company insiders hold 74% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Valued at only HK$149m EFT Solutions Holdings is really small for a listed company. So despite a large proportional holding, insiders only have HK$110m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

Does EFT Solutions Holdings Deserve A Spot On Your Watchlist?

One positive for EFT Solutions Holdings is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. We should say that we've discovered 2 warning signs for EFT Solutions Holdings that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of EFT Solutions Holdings, you'll probably love this curated collection of companies in HK that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.