As of May 2025, the Asian markets are navigating a complex landscape marked by ongoing trade negotiations and mixed economic signals from major global economies. In this context, investors are increasingly looking for opportunities that offer both potential growth and financial stability. Penny stocks, while often associated with speculative investments, can still provide attractive prospects when backed by strong fundamentals. This article will explore three such penny stocks in Asia that stand out for their solid balance sheets and potential for long-term success.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.88 | THB3.03B | ✅ 4 ⚠️ 3 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.40 | THB2.64B | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.192 | SGD38.25M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.18 | SGD8.58B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.88 | HK$3.25B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.02 | HK$46.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.07 | HK$675.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.19 | HK$1.99B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.00 | HK$1.67B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,176 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Guangshen Railway (SEHK:525)

Simply Wall St Financial Health Rating: ★★★★★☆

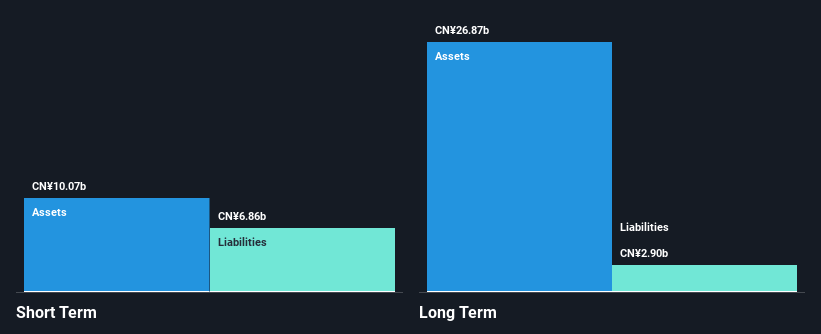

Overview: Guangshen Railway Company Limited operates in the railway passenger and freight transportation sectors in the People’s Republic of China, with a market capitalization of approximately HK$20.48 billion.

Operations: The company's revenue is derived entirely from its operations within China, totaling CN¥27.39 billion.

Market Cap: HK$20.48B

Guangshen Railway's financial stability is supported by its short-term assets exceeding both short and long-term liabilities, while cash reserves surpass total debt. Despite a low return on equity of 3.6% and declining net profit margins, the company maintains high-quality earnings with interest payments well covered by EBIT. Recent results show modest revenue growth but a decline in net income year-on-year for Q1 2025. The stock trades significantly below estimated fair value, offering potential value relative to peers despite an unstable dividend track record and negative earnings growth over the past year compared to industry averages.

- Click to explore a detailed breakdown of our findings in Guangshen Railway's financial health report.

- Review our growth performance report to gain insights into Guangshen Railway's future.

Bangkok Land (SET:BLAND)

Simply Wall St Financial Health Rating: ★★★★★☆

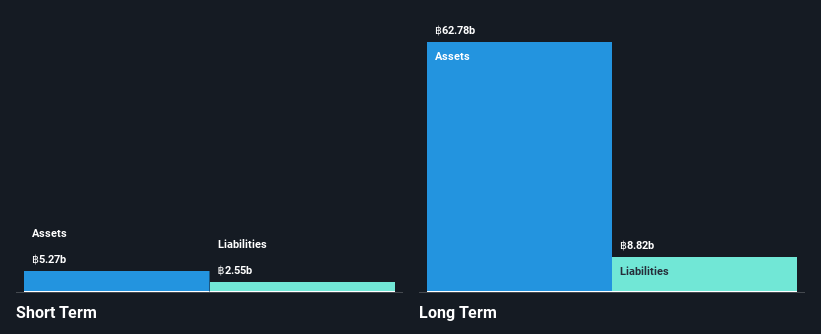

Overview: Bangkok Land Public Company Limited operates in real estate development, exhibition and convention services, food and beverage, education, and hotel investments in Thailand with a market cap of approximately THB8.68 billion.

Operations: The company's revenue is primarily derived from its Exhibition Center Business at THB3.78 billion, followed by the Real Estate Business at THB1.31 billion, Retail Business at THB451 million, and Other Service at THB189 million.

Market Cap: THB8.68B

Bangkok Land's financial profile reveals a mixed picture. The company has demonstrated strong revenue growth, with sales reaching THB4.06 billion for the nine months ending December 2024, up from THB3.06 billion the previous year. Despite this, it reported a net loss of THB65.59 million in Q3 2024 due to large one-off gains impacting earnings quality and low return on equity at 2.9%. However, its debt is well-managed with satisfactory coverage by operating cash flow and interest payments covered by EBIT at 7.2x. Trading significantly below estimated fair value suggests potential investment opportunities despite high volatility and some financial challenges.

- Dive into the specifics of Bangkok Land here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Bangkok Land's track record.

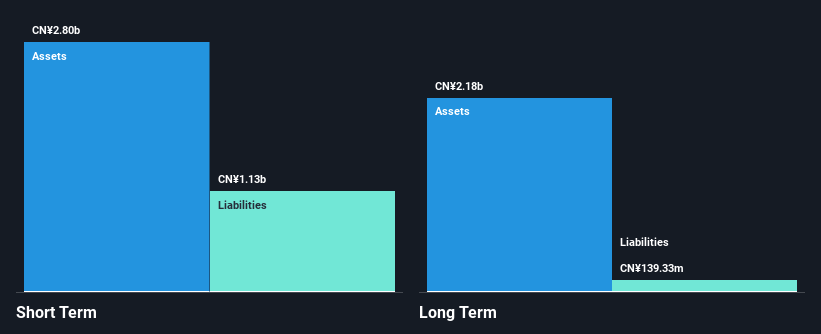

Beijing LeiKe Defense Technology (SZSE:002413)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beijing LeiKe Defense Technology Co., Ltd. operates in the defense technology sector and has a market cap of CN¥5.99 billion.

Operations: The company's revenue primarily comes from its Computer, Communications and Other Electronic Equipment Manufacturing segment, which generated CN¥1.20 billion.

Market Cap: CN¥5.99B

Beijing LeiKe Defense Technology faces challenges as it remains unprofitable, with a net loss of CN¥36.82 million in Q1 2025, despite generating CN¥213.78 million in revenue. The company's financial health is supported by short-term assets exceeding liabilities and a debt to equity ratio reduced to 5% over five years. Although earnings are forecasted to grow significantly, the inexperienced board may impact strategic direction. The management team has more experience with an average tenure of 4.3 years, and cash reserves provide a runway for over three years, mitigating immediate liquidity risks amidst ongoing losses and market volatility.

- Navigate through the intricacies of Beijing LeiKe Defense Technology with our comprehensive balance sheet health report here.

- Gain insights into Beijing LeiKe Defense Technology's future direction by reviewing our growth report.

Next Steps

- Access the full spectrum of 1,176 Asian Penny Stocks by clicking on this link.

- Contemplating Other Strategies? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com