13 analysts have shared their evaluations of Revolve Gr (NYSE:RVLV) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 3 | 6 | 0 | 0 |

| Last 30D | 0 | 2 | 2 | 0 | 0 |

| 1M Ago | 1 | 1 | 2 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 2 | 0 | 0 |

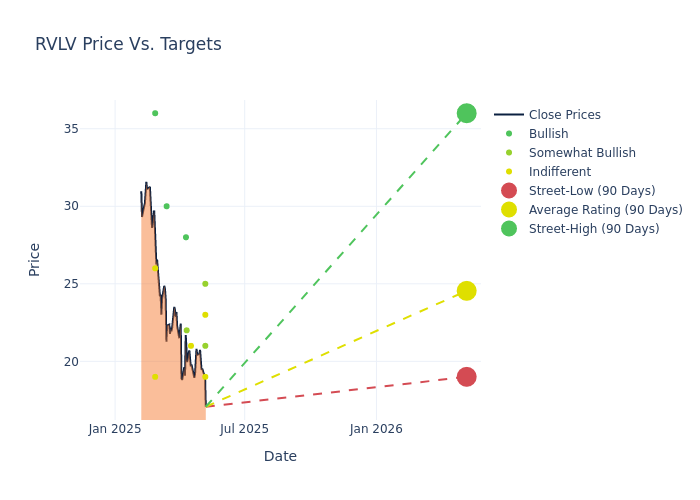

Analysts have recently evaluated Revolve Gr and provided 12-month price targets. The average target is $25.77, accompanied by a high estimate of $40.00 and a low estimate of $19.00. Highlighting a 12.88% decrease, the current average has fallen from the previous average price target of $29.58.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Revolve Gr among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mark Altschwager | Baird | Lowers | Neutral | $23.00 | $25.00 |

| Ashley Owens | Keybanc | Lowers | Overweight | $25.00 | $37.00 |

| Jay Sole | UBS | Lowers | Neutral | $19.00 | $22.00 |

| Rick Paterson | Raymond James | Lowers | Outperform | $21.00 | $25.00 |

| Mark Altschwager | Baird | Lowers | Neutral | $25.00 | $26.00 |

| Lauren Schenk | Morgan Stanley | Lowers | Equal-Weight | $21.00 | $29.00 |

| Anna Andreeva | Piper Sandler | Lowers | Overweight | $22.00 | $35.00 |

| Jim Duffy | Stifel | Lowers | Buy | $28.00 | $40.00 |

| Randal Konik | Jefferies | Announces | Buy | $30.00 | - |

| Matt Koranda | Roth MKM | Raises | Buy | $36.00 | $35.00 |

| Simeon Siegel | BMO Capital | Raises | Market Perform | $19.00 | $15.00 |

| Jim Duffy | Stifel | Lowers | Buy | $40.00 | $41.00 |

| Trevor Young | Barclays | Raises | Equal-Weight | $26.00 | $25.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Revolve Gr. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Revolve Gr compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Revolve Gr's stock. This examination reveals shifts in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Revolve Gr's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Revolve Gr analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Get to Know Revolve Gr Better

The Revolve Group is an emerging e-commerce retailer, selling women's dresses, handbags, shoes, beauty products, and incidentals across its marketplace properties, Revolve and FWRD. The platform is built to suit the "next-generation customer," emphasizing mobile commerce, influencer marketing, and occupying an aspirational but attainable luxury niche. With $1.1 billion in 2024 net sales, the firm sits just outside the top 30 apparel retailers (by sales) in the US, but has consistently generated robust top-line growth as the industry continues to favor digital channels. Revolve generates approximately 18% of sales from private-label offerings, while focusing on building an inventory of unique products from emerging fashion brands with less than $10 million in annual sales.

Revolve Gr: Delving into Financials

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Revolve Gr's revenue growth over a period of 3M has been noteworthy. As of 31 December, 2024, the company achieved a revenue growth rate of approximately 13.95%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Revolve Gr's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.2% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Revolve Gr's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 2.87%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Revolve Gr's ROA excels beyond industry benchmarks, reaching 1.85%. This signifies efficient management of assets and strong financial health.

Debt Management: Revolve Gr's debt-to-equity ratio is below the industry average at 0.09, reflecting a lower dependency on debt financing and a more conservative financial approach.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.