6 analysts have expressed a variety of opinions on Atkore (NYSE:ATKR) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 4 | 0 | 0 |

| Last 30D | 0 | 1 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

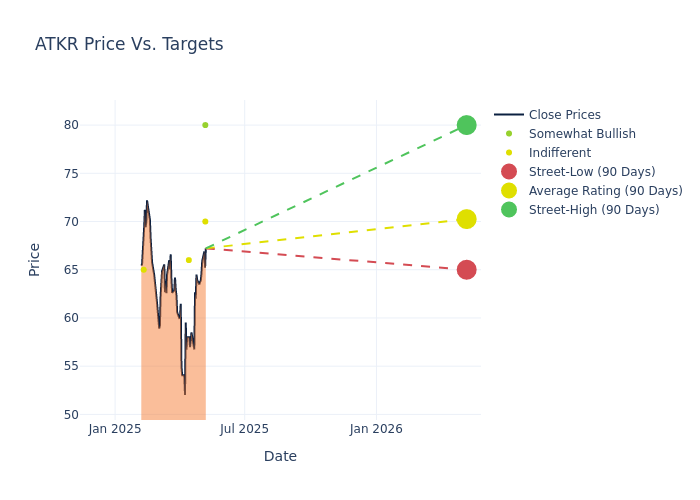

Analysts have set 12-month price targets for Atkore, revealing an average target of $69.33, a high estimate of $80.00, and a low estimate of $65.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 11.87%.

Investigating Analyst Ratings: An Elaborate Study

The standing of Atkore among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Deane Dray | RBC Capital | Raises | Sector Perform | $70.00 | $65.00 |

| Jeffrey Hammond | Keybanc | Raises | Overweight | $80.00 | $70.00 |

| Deane Dray | RBC Capital | Raises | Sector Perform | $65.00 | $64.00 |

| Andrew Kaplowitz | Citigroup | Lowers | Neutral | $66.00 | $78.00 |

| Jeffrey Hammond | Keybanc | Lowers | Overweight | $70.00 | $80.00 |

| Chris Dankert | Loop Capital | Lowers | Hold | $65.00 | $115.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Atkore. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Atkore compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Atkore's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Atkore's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Atkore analyst ratings.

About Atkore

Atkore Inc is a diversified industrials company and a manufacturer of electrical, mechanical, and safety infrastructure solutions. Atkore has two business segments; Electrical and Safety and Infrastructure. Net sales are highest in the electrical business line. The key product categories in the electrical segment are PVC conduit, steel conduit, and PVC-coated conduit, which are staples for electrical distributors. The key product categories in the safety and infrastructure segment include in-line galvanized mechanical tubes, metal framing and related fittings, and security bollards. Also, the company provides ancillary services to customers in the form of slitting and cutting structural steel sheets. Geographically, the company derives its key revenue from the United States.

Key Indicators: Atkore's Financial Health

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Atkore's financials over 3M reveals challenges. As of 31 December, 2024, the company experienced a decline of approximately -17.14% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Atkore's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 6.92%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Atkore's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.0%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Atkore's ROA stands out, surpassing industry averages. With an impressive ROA of 1.53%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.63.

How Are Analyst Ratings Determined?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.