Grocery Outlet Holding (NASDAQ:GO) has been analyzed by 10 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 5 | 1 | 1 |

| Last 30D | 0 | 1 | 1 | 0 | 0 |

| 1M Ago | 1 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 3 | 1 | 1 |

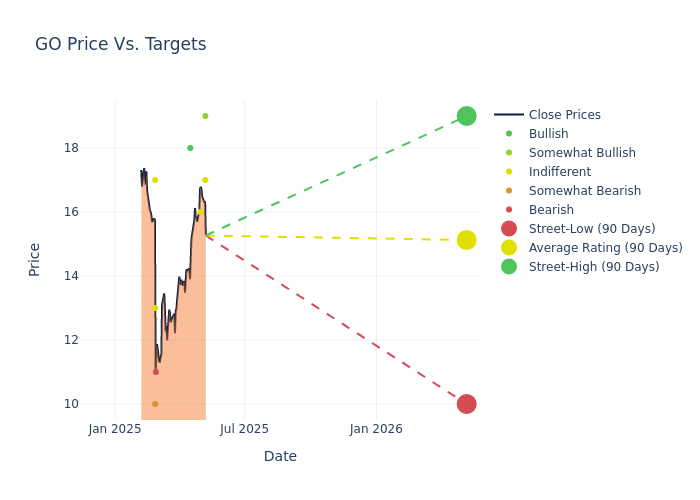

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $15.5, a high estimate of $19.00, and a low estimate of $10.00. Highlighting a 6.34% decrease, the current average has fallen from the previous average price target of $16.55.

Diving into Analyst Ratings: An In-Depth Exploration

The perception of Grocery Outlet Holding by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Lasser | UBS | Raises | Neutral | $17.00 | $14.50 |

| Anthony Bonadio | Wells Fargo | Raises | Overweight | $19.00 | $18.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Market Perform | $16.00 | $16.00 |

| Corey Tarlowe | Jefferies | Raises | Buy | $18.00 | $13.00 |

| Kate McShane | Goldman Sachs | Lowers | Sell | $11.00 | $14.00 |

| Anthony Chukumba | Loop Capital | Lowers | Hold | $13.00 | $16.00 |

| Simeon Gutman | Morgan Stanley | Lowers | Underperform | $10.00 | $13.00 |

| Anthony Bonadio | Wells Fargo | Lowers | Overweight | $18.00 | $23.00 |

| Robert Ohmes | B of A Securities | Lowers | Neutral | $17.00 | $20.00 |

| Joseph Feldman | Telsey Advisory Group | Lowers | Market Perform | $16.00 | $18.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Grocery Outlet Holding. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Grocery Outlet Holding compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Grocery Outlet Holding's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Grocery Outlet Holding's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Grocery Outlet Holding analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Delving into Grocery Outlet Holding's Background

Grocery Outlet Holding Corp is a grocery store operator in the United States. It is a retailer of quality, name-brand consumables and fresh products sold through a network of independently operated stores. The stores are run by Entrepreneurial independent operators which create a neighborhood feel through personalized customer service and a localized product offering.

Grocery Outlet Holding: Delving into Financials

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Over the 3M period, Grocery Outlet Holding showcased positive performance, achieving a revenue growth rate of 10.91% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Consumer Staples sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 0.21%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 0.19%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Grocery Outlet Holding's ROA stands out, surpassing industry averages. With an impressive ROA of 0.07%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Grocery Outlet Holding's debt-to-equity ratio is below the industry average. With a ratio of 1.38, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Core of Analyst Ratings: What Every Investor Should Know

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.