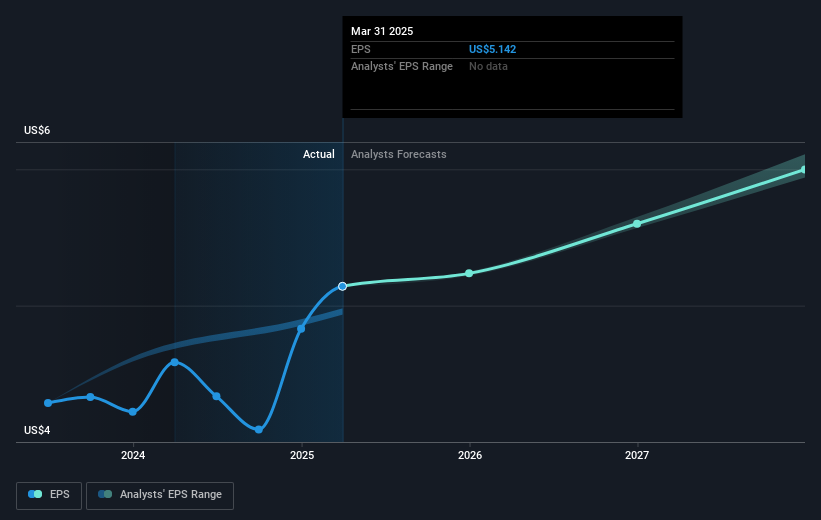

WEC Energy Group (NYSE:WEC) has demonstrated robust financial performance, with Q1 2025 results showing substantial growth in sales, net income, and earnings per share compared to the previous year. These financial improvements, alongside the affirmation of its 331st consecutive quarterly dividend, underscore the company's consistent shareholder value. Despite broader market uncertainties related to Fed interest rate decisions and ongoing trade discussions, WEC's performance and dividend announcement may have influenced its share price advance of 9% over the last quarter, rather than counteracting the general momentum reflected in market trends.

The recent affirmation of Q1 2025's robust financial performance and dividend upkeep at WEC Energy Group may influence future growth narratives centered around expanding data centers and renewable energy investments. Over the last five years, total shareholder returns, including dividends, amounted to a significant 51.94%. This long-term gain provides a wider context, revealing a consistent upward trend in value for shareholders.

In terms of short-term performance, WEC's market capitalization appreciation outpaced the broader US market over the last year. Meanwhile, the company's strategic investments and regulatory support are likely to maintain stable revenue and earnings forecasts. The current price target of US$105.39 implies a slight price correction from the recent market value of US$109.15, signaling anticipation of a moderate recalibration in valuation.

Take a closer look at WEC Energy Group's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com