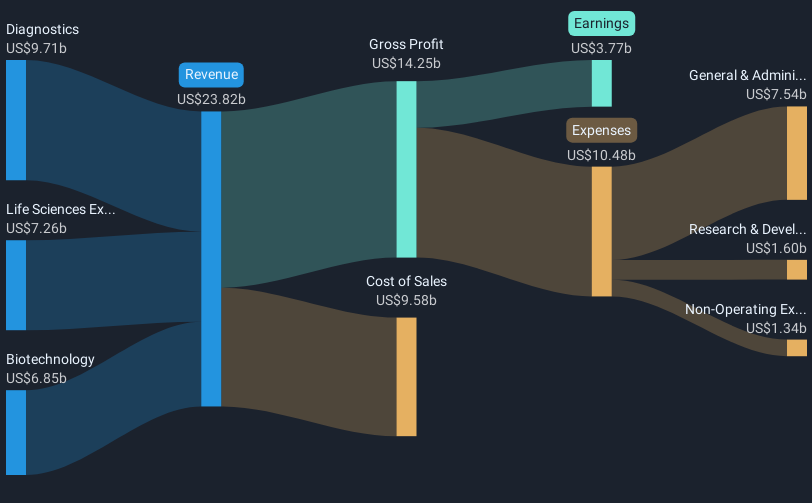

Danaher (NYSE:DHR) recently affirmed a quarterly dividend of $0.32 per share, set for payout in July. Over the past month, the company's share price rose by 5%, reflecting a positive market response amid mixed broader market trends, as the Dow Jones and other indices showed varied movements tied to economic policies and earnings reports. Despite a decline in Q1 earnings and a buyback update, the dividend announcement likely added favorable sentiment towards Danaher's stock. This period's performance suggests a degree of resilience in the face of broader market fluctuations, with investor focus possibly bolstered by stable dividend policies.

Be aware that Danaher is showing 1 possible red flag in our investment analysis.

The recent affirmation of Danaher's dividend, coupled with a 5% share price rise in the past month, may indicate positive market sentiment towards the company's consistent dividend policy. This news comes amid a backdrop of geopolitical and economic challenges that could affect revenue streams and earnings stability. The focus on bioprocessing and new technologies aims to drive long-term growth, but potential pressures from the life sciences sector and China may affect profitability.

Over the last five years, Danaher's total shareholder return, including dividends, was 36.48%. While this showcases a robust long-term performance, it's important to note the recent challenges. In the past year, Danaher underperformed the US market, which saw a 7.2% uptick, although it did fare better than the Life Sciences industry, which experienced a 29.5% decline. This context underscores both past resilience and current hurdles.

Looking forward, the dividend and buyback activities might positively influence revenue and earnings forecasts. Analysts currently estimate revenue growth of 6.2% annually, with an expected earnings rise to US$5.6 billion by 2028. The consensus price target of US$247.19, a 19.5% premium over today's price of US$198.93, reflects these projections. However, risks such as geopolitical tensions and sector-specific challenges could impact these forecasts, necessitating careful monitoring of upcoming developments.

Learn about Danaher's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com