United Rentals (NYSE:URI) announced a series of new safety and efficiency products targeting contractors, a move likely boosting its recent share price increase of 15% over the past month. The introduction of solutions like equipment access management and ground protection mats highlights its commitment to enhancing job site safety. Additionally, the company's Q1 earnings release showed revenue growth, potentially adding momentum to its stock performance. While the market remained mixed, with the Dow and S&P 500 seeing modest gains, United Rentals' product innovations and solid financial results may have positioned it favorably during this period.

Find companies with promising cash flow potential yet trading below their fair value.

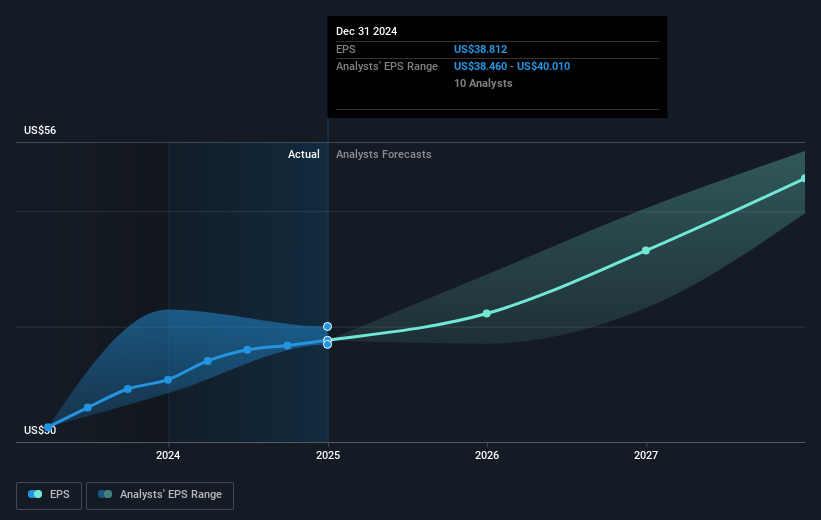

United Rentals' recent initiatives in launching safety and efficiency products highlight its focus on innovation and operational excellence, potentially enhancing future revenue streams and supporting earnings forecasts. This strategic direction aligns with the company's ongoing efforts to expand its Specialty business, which has seen significant growth. Such efforts could sustain the momentum in revenue, reflected in a high earnings growth rate projected by analysts for the coming years. These developments could help bridge the current share price to the analyst consensus price target of US$732.06, with United Rentals' current trading price showing a 13.9% upside potential based on this target.

Over the past five years, United Rentals has delivered over a 500% total return for shareholders, illustrating a robust long-term performance. This performance contrasts with its 1.4% earnings growth over the past year, which still outpaced the Trade Distributors industry, which saw a contraction of 9.2% in the same period. Such positive long-term trends, coupled with the company's strategy to leverage cross-selling and reduce share count through repurchases, may enhance shareholder value further. Though recent market activity has been volatile, the company's ability to align its operational initiatives with market demand could solidify its financial prospects and sustain its growth trajectory.

Explore United Rentals' analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com