4 analysts have shared their evaluations of Grand Canyon Education (NASDAQ:LOPE) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 4 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 0 | 0 | 0 |

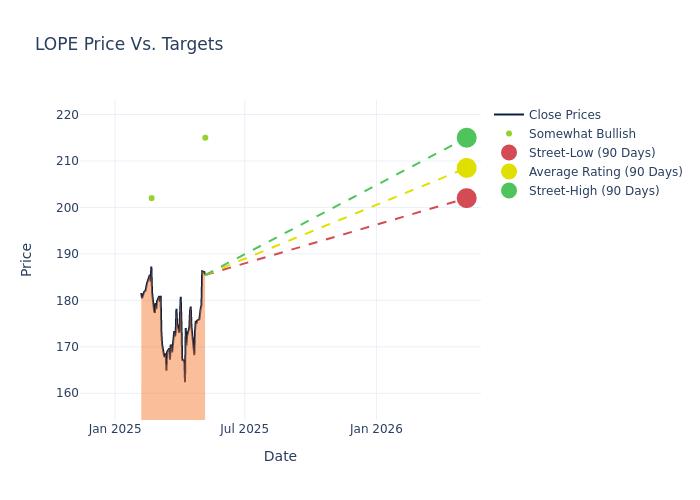

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $206.75, with a high estimate of $215.00 and a low estimate of $202.00. Surpassing the previous average price target of $192.75, the current average has increased by 7.26%.

Understanding Analyst Ratings: A Comprehensive Breakdown

The perception of Grand Canyon Education by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Alexander Paris | Barrington Research | Raises | Outperform | $215.00 | $205.00 |

| Alexander Paris | Barrington Research | Maintains | Outperform | $205.00 | $205.00 |

| Jeffrey Silber | BMO Capital | Raises | Outperform | $202.00 | $181.00 |

| Alexander Paris | Barrington Research | Raises | Outperform | $205.00 | $180.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Grand Canyon Education. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Grand Canyon Education compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Grand Canyon Education's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Grand Canyon Education's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Grand Canyon Education analyst ratings.

About Grand Canyon Education

Grand Canyon Education Inc is a publicly traded education services company dedicated to serving colleges and universities. GCE's university partner is Grand Canyon University, an Arizona non-profit corporation that operates a comprehensive regionally accredited university that offers graduate and undergraduate degree programs, emphases, and certificates across nine colleges both online, on the ground at its campus in Phoenix, Arizona and at four off-site classroom and laboratory sites. The Company generates all of its revenue through services agreements with its university partners.

Grand Canyon Education: Delving into Financials

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Positive Revenue Trend: Examining Grand Canyon Education's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 5.13% as of 31 December, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 27.99%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Grand Canyon Education's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.58% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Grand Canyon Education's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 8.14% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 0.14, Grand Canyon Education adopts a prudent financial strategy, indicating a balanced approach to debt management.

Understanding the Relevance of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.