Wall Street's Most Accurate Analysts Give Their Take On 3 Industrials Stocks Delivering High-Dividend Yields

Benzinga · 5d ago

Share

Listen to the news

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the industrials sector.

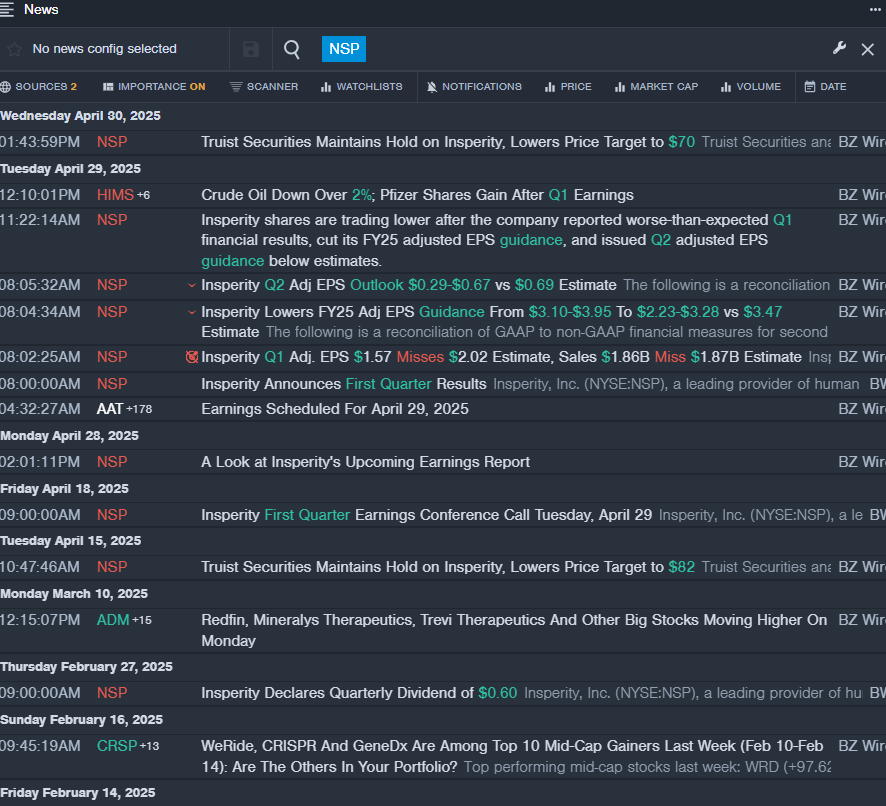

Insperity, Inc. (NYSE:NSP)

- Dividend Yield: 3.67%

- Truist Securities analyst Tobey Sommer maintained a Hold rating and cut the price target from $82 to $70 on April 30, 2025. This analyst has an accuracy rate of 72%.

- JP Morgan analyst Andrew Polkowitz initiated coverage on the stock with an Underweight rating and a price target of $90 on Oct. 22, 2024. This analyst has an accuracy rate of 66%.

- Recent News: On April 29, Insperity reported worse-than-expected first-quarter financial results and cut its FY25 adjusted EPS guidance.

- Benzinga Pro’s real-time newsfeed alerted to latest NSP news.

Kennametal Inc. (NYSE:KMT)

- Dividend Yield: 4.04%

- Barclays analyst Julian Mitchell maintained an Equal-Weight rating and cut the price target from $24 to $22 on April 10, 2025. This analyst has an accuracy rate of 73%.

- Jefferies analyst Stephen Volkmann downgraded the stock from Buy to Hold and slashed the price target from $40 to $32 on Dec. 6, 2024. This analyst has an accuracy rate of 70%.

- Recent News: Kennametal will host its third quarter fiscal year 2025 earnings call on Wednesday, May 7.

- Benzinga Pro's real-time newsfeed alerted to latest KMT news

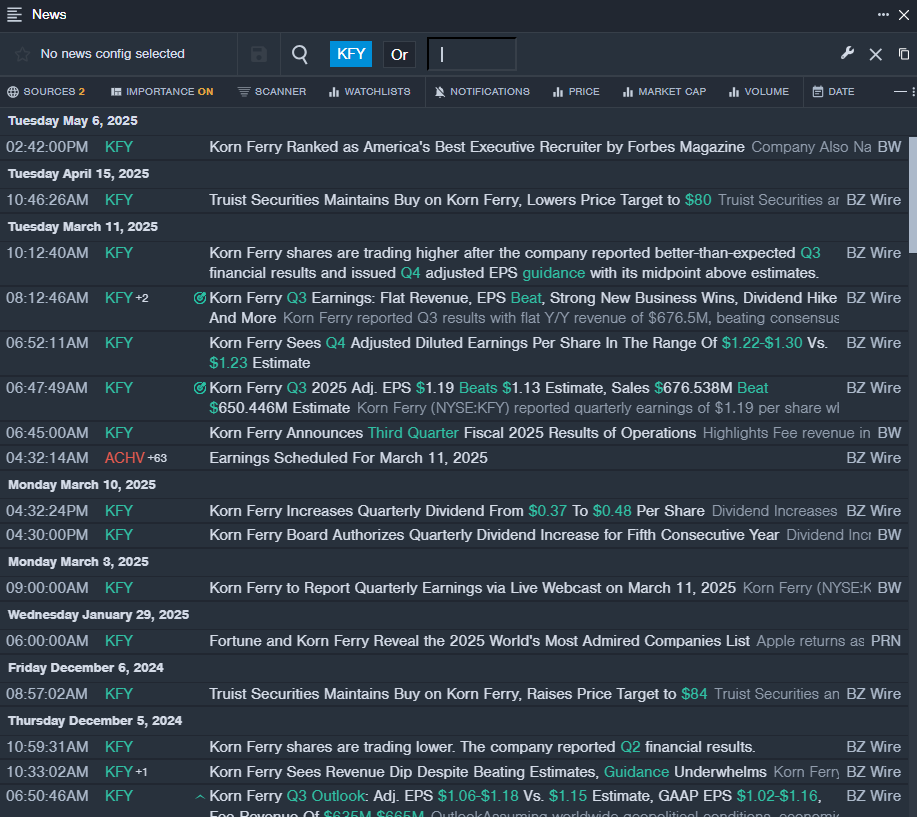

Korn Ferry (NYSE:KFY)

- Dividend Yield: 2.49%

- Truist Securities analyst Tobey Sommer maintained a Buy rating and cut the price target from $84 to $80 on April 15, 2025. This analyst has an accuracy rate of 72%.

- Baird analyst Mark Marcon maintained an Outperform rating and increased the price target from $72 to $79 on June 14, 2024. This analyst has an accuracy rate of 73%.

- Recent News: On March 11, Korn Ferry reported better-than-expected third-quarter financial results and issued fourth-quarter adjusted EPS guidance with its midpoint above estimates.

- Benzinga Pro’s real-time newsfeed alerted to latest KFY news

Read More:

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved