Acadian Asset Management Inc. (NYSE:AAMI) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 29%.

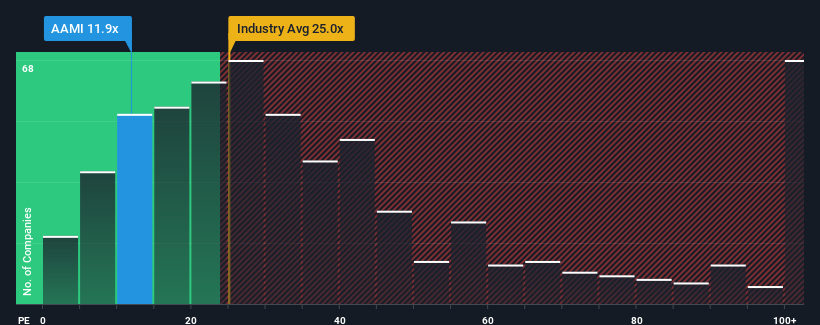

In spite of the firm bounce in price, Acadian Asset Management may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 11.9x, since almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 32x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

We've discovered 2 warning signs about Acadian Asset Management. View them for free.Recent times have been quite advantageous for Acadian Asset Management as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Acadian Asset Management

Is There Any Growth For Acadian Asset Management?

There's an inherent assumption that a company should underperform the market for P/E ratios like Acadian Asset Management's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 45% last year. The latest three year period has also seen an excellent 112% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 13% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that Acadian Asset Management's P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Acadian Asset Management's P/E?

The latest share price surge wasn't enough to lift Acadian Asset Management's P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Acadian Asset Management currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you take the next step, you should know about the 2 warning signs for Acadian Asset Management that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.