Cincinnati Financial (NasdaqGS:CINF) recently approved amended articles of incorporation and declared a regular quarterly dividend of 87 cents per share during its annual meeting on May 3, 2025. These announcements, reflecting stability in corporate governance and commitment to returning value to shareholders, may have added positive sentiment to the company’s performance. Despite the broader market trends and a net loss reported in Q1 2025, the 9% price increase observed over the last month aligns with general shareholder optimism, suggesting that Cincinnati Financial's developments provided additional support to the upward trajectory amidst a market showing mild overall gains.

The recent announcements from Cincinnati Financial, involving amended articles of incorporation and a steady dividend, potentially reflect positively on its governance and shareholder value, which may have influenced the recent share price uptick. Examining a broader horizon, Cincinnati Financial shares have experienced a substantial total return of 204.85% over the five years leading up to May 2025, indicating considerable long-term value creation for shareholders.

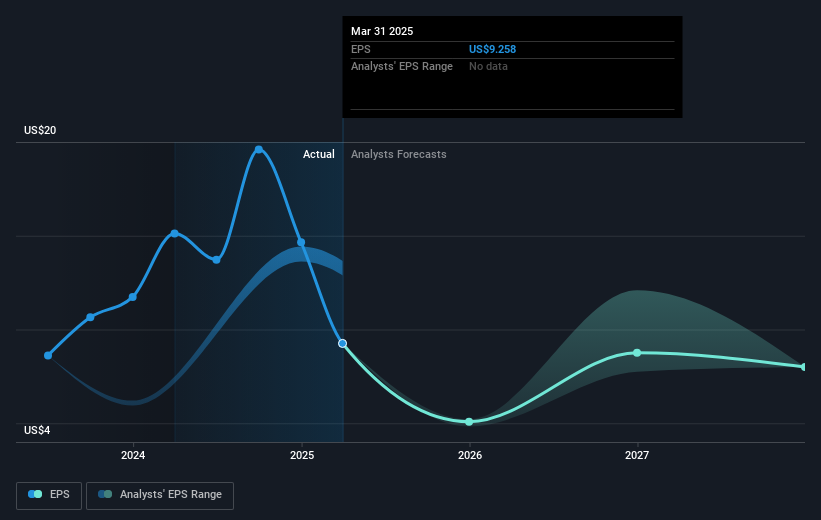

While the recent 9% monthly increase in share price can be seen as aligning with shareholder optimism, it's crucial to consider it within the framework of the analysts' consensus price target of US$151.67, which is approximately 7.8% higher than the current price of US$139.85. The effective execution of the company's strategies will be critical in bridging this gap. This context also suggests that the company's long-term trajectory could remain influenced by its challenges, such as exposure to catastrophic events and competitive pressures in specific segments. On the financial forecast front, analysts anticipate a 5.9% annual revenue growth and a contraction in profit margins over the next three years, underlining potential pressures on profitability that merit close monitoring.

Meanwhile, Cincinnati Financial's one-year return has outpaced the broader US market, reflecting some resilience amid sector-wide challenges. The recent developments may bolster investor confidence, yet the pressures from environmental events and competitive dynamics could play pivotal roles in shaping the company's financial outlook, particularly regarding forecasted earnings and revenue growth. Overall, stakeholders should weigh these elements to derive a comprehensive understanding of potential future performance relative to market trends and analyst expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com