Henry Schein Inc. (NASDAQ:HSIC) reported mixed results for its first-quarter on Monday.

The company posted adjusted EPS of $1.15, up 4.5% year over year, beat the consensus of $1.11. Sales were $3.17 billion, missing the consensus of $3.23 billion.

"We are pleased with our first quarter financial results as well as the momentum we are seeing heading into the second quarter and remain confident in the fundamentals of our business," said Stanley M. Bergman, chairman of the board and CEO of Henry Schein.

Henry Schein affirmed 2025 adjusted EPS of $4.80-$4.94 versus a consensus of $4.86. The company also expects sales growth of approximately 2%—4% over 2024, of $12.43 billion—$13.18 billion versus a consensus of $13 billion.

The company's 2025 adjusted EBITDA growth is unchanged and is expected to increase by mid-single digits compared with 2024. The company said the guidance also assumes that foreign currency exchange rates remain generally consistent with current levels and that additional tariffs will not be introduced.

Henry Schein shares gained 0.2% to trade at $66.68 on Tuesday.

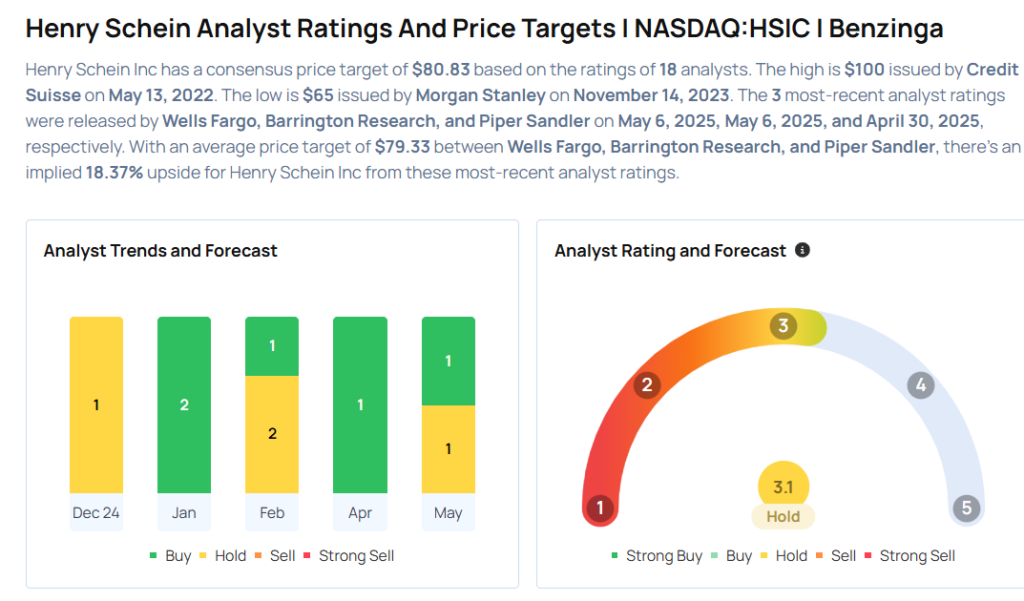

These analysts made changes to their price targets on Henry Schein following earnings announcement.

- Barrington Research analyst Michael Petusky maintained Henry Schein with an Outperform rating and lowered the price target from $90 to $86.

- Wells Fargo analyst Vik Chopra maintained the stock with an Equal-Weight rating and lowered the price target from $80 to $75.

Considering buying HSIC stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock