Top 2 Energy Stocks That Are Ticking Portfolio Bombs

Benzinga · 6d ago

Share

Listen to the news

As of May 6, 2025, two stocks in the energy sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Teekay Tankers Ltd (NYSE:TNK)

- Teekay will release their financial results for the first quarter after the closing bell on Wednesday, May 7. Analysts expect the company to report quarterly earnings at $1.15 per share on revenue of $144.85 million. The company's stock jumped around 23% over the past month and has a 52-week high of $74.20.

- RSI Value: 73.8

- TNK Price Action: Shares of Teekay Tankers jumped 4.7% to close at $46.17 on Monday.

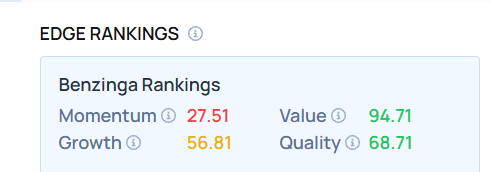

- Edge Stock Ratings: 27.51 Momentum score with Value at 94.71.

Frontline Plc (NYSE:FRO)

- On April 22, Evercore ISI Group analyst Jonathan Chappell maintained Frontline with an Outperform rating and lowered the price target from $22 to $20. The company's stock gained around 24% over the past month and has a 52-week high of $29.39.

- RSI Value: 70.5

- FRO Price Action: Shares of Frontline gained 3.9% to close at $17.79 on Monday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved