As global markets navigate a landscape marked by easing trade concerns and mixed economic signals, the Asian market remains a focal point for investors seeking opportunities in an evolving economic climate. Penny stocks, often associated with smaller or newer companies, continue to attract attention due to their potential for growth and affordability. Despite the term's outdated connotation, these stocks can offer significant value when supported by strong financials, making them intriguing prospects for those looking to explore under-the-radar investments in Asia.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.84 | THB3B | ✅ 4 ⚠️ 3 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.58 | THB1.63B | ✅ 2 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.19 | SGD37.85M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.11 | SGD8.3B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.93 | HK$3.34B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.06 | HK$46.48B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.06 | HK$668.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.15 | HK$1.92B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.95 | HK$1.62B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,176 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Fu Shou Yuan International Group (SEHK:1448)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fu Shou Yuan International Group Limited, along with its subsidiaries, offers burial and funeral services in the People's Republic of China and has a market cap of HK$8.27 billion.

Operations: The company generates revenue from three main segments: Burial Services with CN¥1.71 billion, Funeral Services totaling CN¥339.19 million, and Other Services amounting to CN¥37.44 million.

Market Cap: HK$8.27B

Fu Shou Yuan International Group, with a market cap of HK$8.27 billion, faces challenges despite its strong cash flow coverage of debt and reduced debt-to-equity ratio over five years. Recent earnings reveal a decline in revenue to CN¥2.08 billion and net income to CN¥373.13 million, largely due to economic conditions and increased tax expenses affecting subsidiaries. The company's dividend yield is high but not well-supported by earnings or free cash flows, raising sustainability concerns. While trading below estimated fair value suggests potential upside, negative growth trends and an inexperienced management team warrant cautious consideration for investors focused on penny stocks in Asia.

- Navigate through the intricacies of Fu Shou Yuan International Group with our comprehensive balance sheet health report here.

- Explore Fu Shou Yuan International Group's analyst forecasts in our growth report.

Guangzhou Automobile Group (SEHK:2238)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Guangzhou Automobile Group Co., Ltd. operates in the research, development, manufacture, and sale of vehicles and motorcycles, along with parts and components both in Mainland China and internationally, with a market cap of HK$70.65 billion.

Operations: Guangzhou Automobile Group generates revenue through its operations in vehicle and motorcycle research, development, manufacture, and sales, including parts and components, with a focus on both Mainland China and international markets.

Market Cap: HK$70.65B

Guangzhou Automobile Group, with a market cap of HK$70.65 billion, shows mixed signals for penny stock investors. Despite having more cash than debt and short-term assets exceeding liabilities, the company faces challenges with increasing losses and negative return on equity due to recent unprofitability. The first quarter of 2025 saw a net loss of CNY 731.61 million compared to a profit in the previous year, alongside declining sales volumes. However, its share buyback program might indicate management's confidence in future prospects. Investors should weigh these factors against industry volatility and potential growth forecasts before considering this stock in their portfolios.

- Click to explore a detailed breakdown of our findings in Guangzhou Automobile Group's financial health report.

- Gain insights into Guangzhou Automobile Group's outlook and expected performance with our report on the company's earnings estimates.

Digital China Holdings (SEHK:861)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise clients mainly in Mainland China, with a market capitalization of approximately HK$4.37 billion.

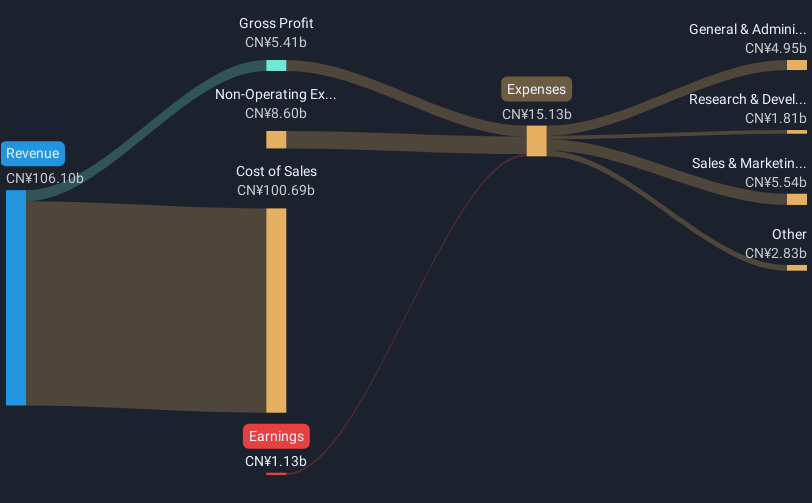

Operations: The company's revenue is primarily derived from three segments: Software and Operating Services (CN¥5.52 billion), Traditional and Localization Services (CN¥7.96 billion), and Big Data Products and Solutions (CN¥3.24 billion).

Market Cap: HK$4.37B

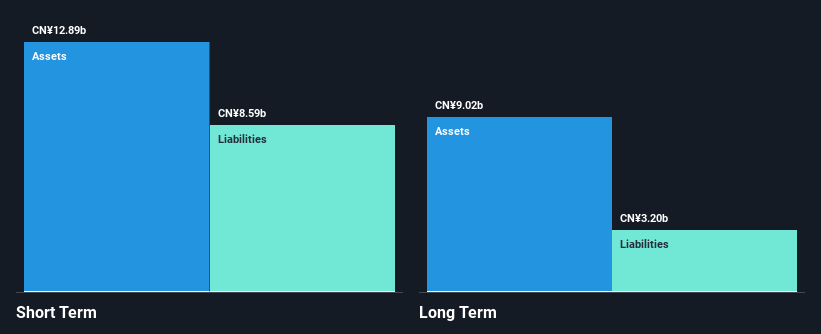

Digital China Holdings, with a market cap of HK$4.37 billion, presents both opportunities and challenges for penny stock investors. The company reported a net loss of CN¥253.95 million for 2024, an improvement from the previous year's larger losses. Despite unprofitability and a negative return on equity of -5.93%, it maintains a strong cash position with short-term assets exceeding liabilities by CN¥4.2 billion and more cash than total debt, ensuring over three years of runway even as free cash flow shrinks annually by 16%. The board's inexperience contrasts with the seasoned management team averaging 6.9 years in tenure.

- Jump into the full analysis health report here for a deeper understanding of Digital China Holdings.

- Gain insights into Digital China Holdings' past trends and performance with our report on the company's historical track record.

Make It Happen

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 1,173 more companies for you to explore.Click here to unveil our expertly curated list of 1,176 Asian Penny Stocks.

- Contemplating Other Strategies? Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com