In the preceding three months, 6 analysts have released ratings for Noble Corp (NYSE:NE), presenting a wide array of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 2 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

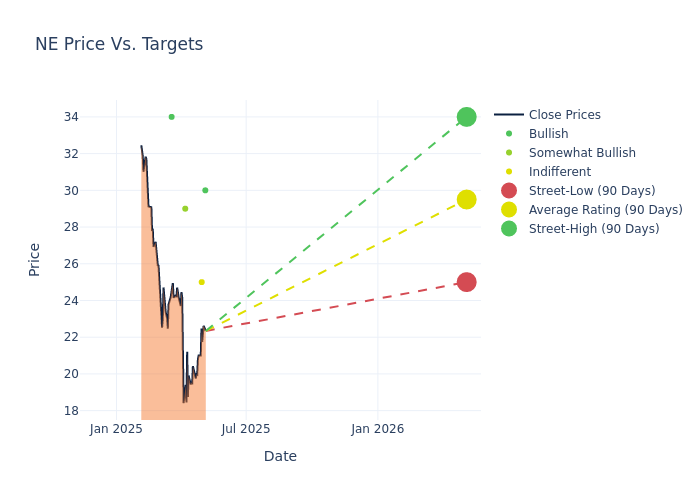

The 12-month price targets, analyzed by analysts, offer insights with an average target of $29.83, a high estimate of $39.00, and a low estimate of $22.00. Experiencing a 17.53% decline, the current average is now lower than the previous average price target of $36.17.

Analyzing Analyst Ratings: A Detailed Breakdown

The analysis of recent analyst actions sheds light on the perception of Noble Corp by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Greg Lewis | BTIG | Lowers | Buy | $30.00 | $40.00 |

| Charles Minervino | Susquehanna | Raises | Neutral | $25.00 | $22.00 |

| Charles Minervino | Susquehanna | Lowers | Neutral | $22.00 | $33.00 |

| Eddie Kim | Barclays | Lowers | Overweight | $29.00 | $39.00 |

| Scott Gruber | Citigroup | Lowers | Buy | $34.00 | $40.00 |

| Eddie Kim | Barclays | Lowers | Overweight | $39.00 | $43.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Noble Corp. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Noble Corp compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Noble Corp's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Noble Corp's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Noble Corp analyst ratings.

Unveiling the Story Behind Noble Corp

Noble Corp PLC is an offshore drilling contractor for the oil and gas industry that provides contract drilling services to the international oil and gas industry with its fleet of mobile offshore drilling units. The company focuses on a high-specification fleet of floating and jackup rigs and the deployment of its drilling rigs in oil and gas basins around the world.

Noble Corp: Financial Performance Dissected

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Noble Corp's revenue growth over a period of 3M has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 37.26%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Energy sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Noble Corp's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 12.38% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.33%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Noble Corp's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.36%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.42, Noble Corp adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.