Huntsman Corporation (NYSE:HUN) reported in-line loss for the first quarter, after the closing bell on Thursday.

The company posted a quarterly loss of 11 cents per share, which met the analyst consensus estimate. The company reported quarterly sales of $1.41 billion which missed the analyst consensus estimate of $1.49 billion.

Peter R. Huntsman, Chairman, President, and CEO, said, “Since our last earnings call, short term business conditions continue to change markedly. Low visibility and customer uncertainty regarding demand trends over the coming months are pressuring order patterns in many of our key markets, including construction, transportation, and other industrial related markets. The cautious customer order patterns are muting the seasonal volume improvement our markets typically experience during the second quarter. While we are hopeful that demand conditions improve, we are not waiting for that to happen and remain aggressive on costs which include announced workforce reductions as well as asset optimization in both Europe and North America. We are on-track to complete our review of strategic options for our European maleic anhydride business by this summer, which we will communicate once completed. Protecting the balance sheet remains a priority in addition to focusing on cash generation as we navigate the Company through the current environment.”

Huntsman shares fell 2.8% to trade at $11.77 on Monday.

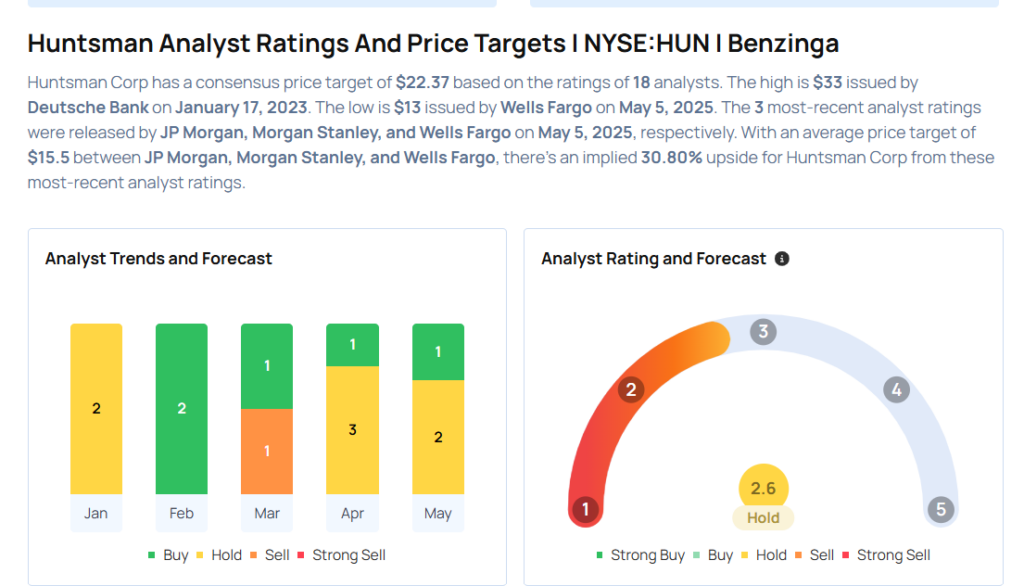

These analysts made changes to their price targets on Huntsman following earnings announcement.

- Morgan Stanley analyst Angel Castillo maintained Huntsman with an Equal-Weight rating and lowered the price target from $20 to $13.5.

- JP Morgan analyst Jeffrey Zekauskas maintained the stock with an Overweight rating and lowered the price target from $22 to $20.

Considering buying HUN stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock