In a period marked by easing trade tensions and unexpectedly robust job growth, global markets have shown resilience despite ongoing economic uncertainties. As investors navigate this complex landscape, identifying undervalued stocks can offer potential opportunities for those seeking value investments.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Aidma Holdings (TSE:7373) | ¥1843.00 | ¥3675.49 | 49.9% |

| Sany Renewable EnergyLtd (SHSE:688349) | CN¥22.70 | CN¥44.89 | 49.4% |

| RACCOON HOLDINGS (TSE:3031) | ¥798.00 | ¥1576.52 | 49.4% |

| Truecaller (OM:TRUE B) | SEK75.15 | SEK148.30 | 49.3% |

| Lectra (ENXTPA:LSS) | €24.10 | €47.78 | 49.6% |

| Boreo Oyj (HLSE:BOREO) | €15.30 | €30.38 | 49.6% |

| FACC (WBAG:FACC) | €7.08 | €14.09 | 49.8% |

| ATON Green Storage (BIT:ATON) | €1.92 | €3.83 | 49.9% |

| HanJung Natural Connectivity System.co.Ltd (KOSDAQ:A107640) | ₩27400.00 | ₩54530.89 | 49.8% |

| W5 Solutions (OM:W5) | SEK76.40 | SEK151.39 | 49.5% |

Let's take a closer look at a couple of our picks from the screened companies.

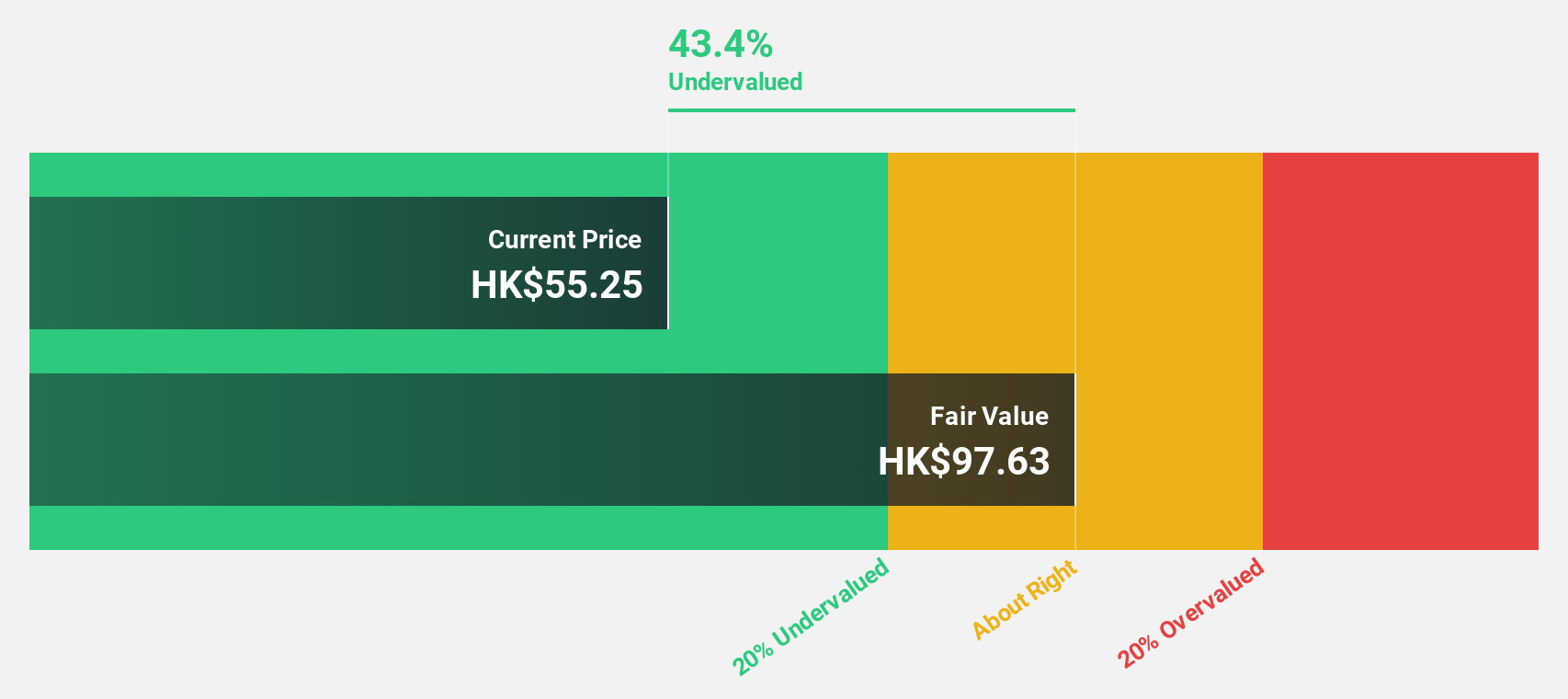

ASMPT (SEHK:522)

Overview: ASMPT Limited is an investment holding company involved in designing, manufacturing, and marketing machines, tools, and materials for the semiconductor and electronics assembly industries globally with a market cap of approximately HK$22.24 billion.

Operations: The company's revenue is derived from two main segments: Semiconductor Solutions, contributing HK$7.42 billion, and Surface Mount Technology (SMT) Solutions, accounting for HK$5.79 billion.

Estimated Discount To Fair Value: 49.1%

ASMPT is trading significantly below its estimated fair value, making it potentially undervalued based on cash flows. Despite recent earnings showing a decline in net income to HK$83.64 million from HK$179.91 million year-over-year, the company's earnings are forecasted to grow 36.9% annually, outpacing the Hong Kong market's growth rate. However, profit margins have decreased from 4.1% to 1.9%, and its return on equity is expected to be modest at 12.9% in three years.

- Our growth report here indicates ASMPT may be poised for an improving outlook.

- Dive into the specifics of ASMPT here with our thorough financial health report.

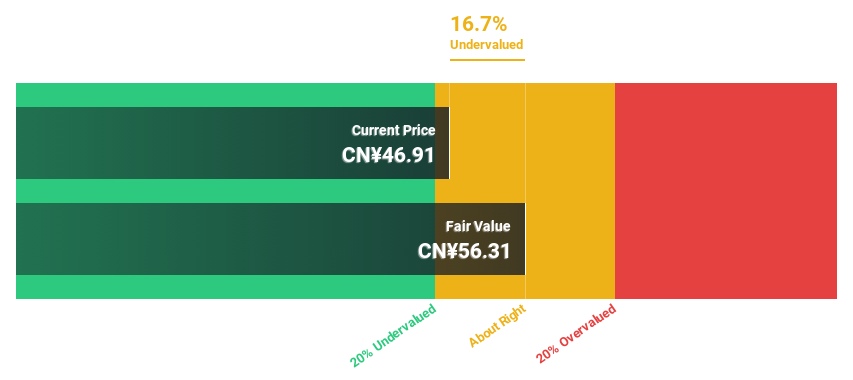

China National Software & Service (SHSE:600536)

Overview: China National Software & Service Company Limited operates as a software company in China with a market cap of CN¥38.44 billion.

Operations: The company's revenue is primarily derived from its Software Service Business, which generated CN¥5.14 billion.

Estimated Discount To Fair Value: 18.6%

China National Software & Service is trading at CN¥45.38, below its estimated fair value of CN¥55.74, suggesting potential undervaluation based on cash flows. Despite a recent decline in quarterly revenue to CN¥640.5 million from the previous year's CN¥702.71 million, earnings are forecast to grow 100% annually with expected profitability within three years. However, return on equity remains low at a projected 9.8%, and recent net losses have narrowed compared to last year’s figures.

- Our expertly prepared growth report on China National Software & Service implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of China National Software & Service with our comprehensive financial health report here.

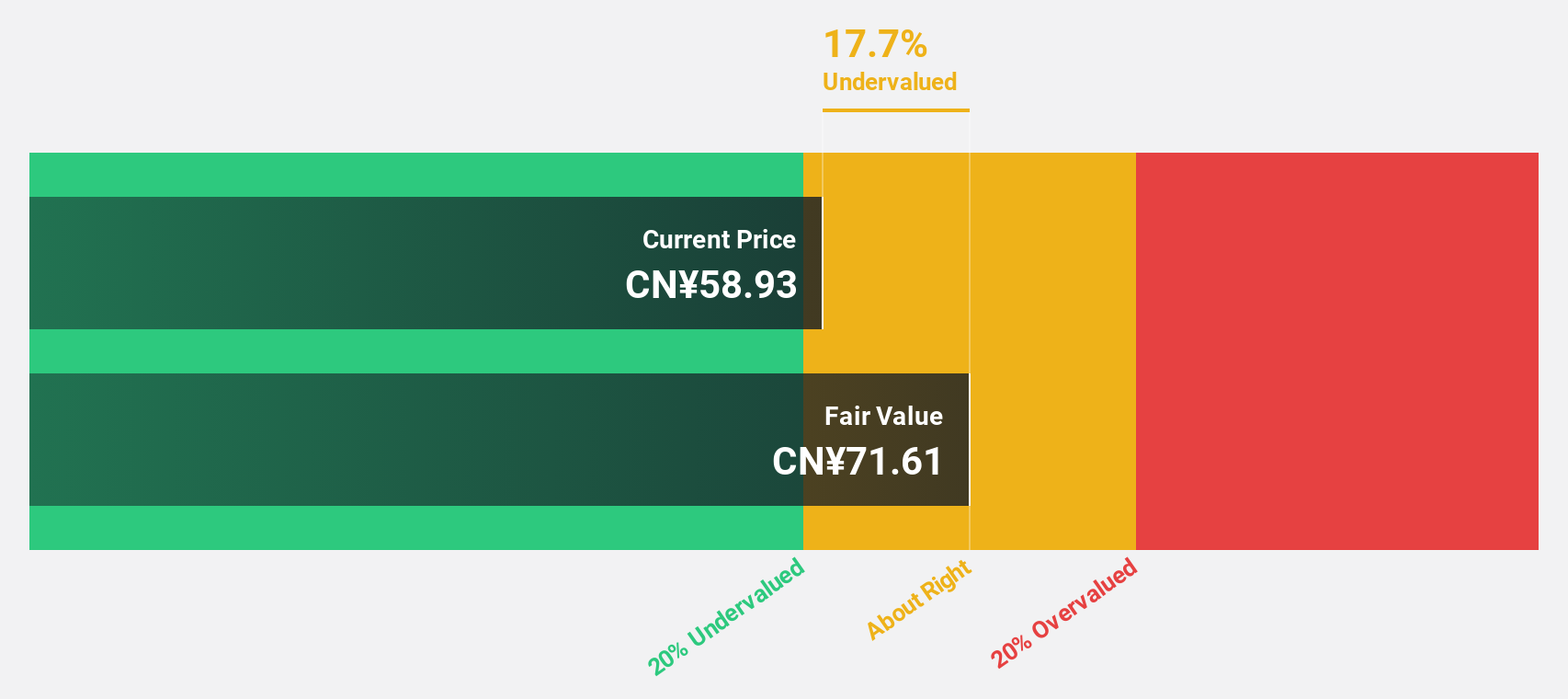

CSPC Innovation Pharmaceutical (SZSE:300765)

Overview: CSPC Innovation Pharmaceutical Co., Ltd. focuses on the research, development, production, and sales of biopharmaceuticals, APIs, and functional foods both in China and internationally with a market cap of CN¥58.36 billion.

Operations: The company generates revenue through its activities in biopharmaceuticals, active pharmaceutical ingredients (APIs), and functional foods across domestic and international markets.

Estimated Discount To Fair Value: 44.1%

CSPC Innovation Pharmaceutical, trading at CN¥41.91, is significantly undervalued compared to its estimated fair value of CN¥74.98. Despite a recent net loss of CN¥26.9 million for Q1 2025 and declining revenue from the previous year, the company is expected to achieve profitability within three years with robust revenue growth forecasts of 37% annually—outpacing the market average. However, its return on equity remains modest at a projected 15.4%.

- Our earnings growth report unveils the potential for significant increases in CSPC Innovation Pharmaceutical's future results.

- Get an in-depth perspective on CSPC Innovation Pharmaceutical's balance sheet by reading our health report here.

Seize The Opportunity

- Gain an insight into the universe of 469 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com