Those holding Donnelley Financial Solutions, Inc. (NYSE:DFIN) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 18% over that time.

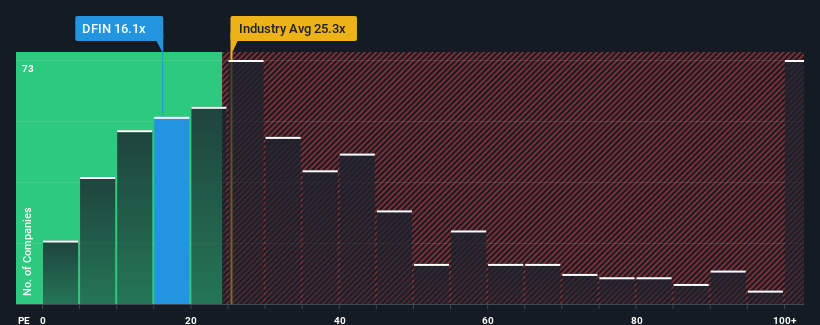

Even after such a large jump in price, there still wouldn't be many who think Donnelley Financial Solutions' price-to-earnings (or "P/E") ratio of 16.1x is worth a mention when the median P/E in the United States is similar at about 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Donnelley Financial Solutions could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Donnelley Financial Solutions

How Is Donnelley Financial Solutions' Growth Trending?

The only time you'd be comfortable seeing a P/E like Donnelley Financial Solutions' is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 8.8%. The last three years don't look nice either as the company has shrunk EPS by 21% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 11% per year as estimated by the three analysts watching the company. With the market predicted to deliver 10% growth each year, the company is positioned for a comparable earnings result.

In light of this, it's understandable that Donnelley Financial Solutions' P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Donnelley Financial Solutions appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Donnelley Financial Solutions maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Donnelley Financial Solutions you should know about.

If these risks are making you reconsider your opinion on Donnelley Financial Solutions, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.